Live: New Zealand’s central bank cuts rates by 0.5 percentage points, ASX in positive territory

- by Admin

- October 8, 2024

From Mr Kent’s speech:

The TFF was part of the insurance the RBA took out against a catastrophic economic outcome.

While some of the TFF’s design features underpinned its significant use by the banks – and hence its economic benefits more broadly – these were also associated with financial costs for the RBA.

The total cost to the RBA is estimated to have been $9 billion.

There were several reasons for this cost.

First, the choice to supply funds at a fixed rate was intended to give banks and their borrowers certainty, thereby reinforcing the other elements of the policy package: notably the RBA’s three-year yield target, and its forward guidance.

But the economic recovery and increase in inflation turned out to be much stronger, and started much earlier, than the initial upside scenarios considered by most economists and the RBA.

As a result, the board ended up raising the cash rate target by much more and much sooner than had been expected:

While the TFF was profitable for the RBA until May 2022, once the cash rate increased, the RBA was paying banks more interest for the balances that they kept at the RBA than the low fixed rate the banks were paying on the TFF.

Because the banks passed these lower funding costs in full, household and business borrowers who had locked in low fixed rates were the ultimate beneficiaries as interest rates rose.

Second, around $4 billion of this cost was the result of the Board’s decision to extend the TFF in early September 2020.

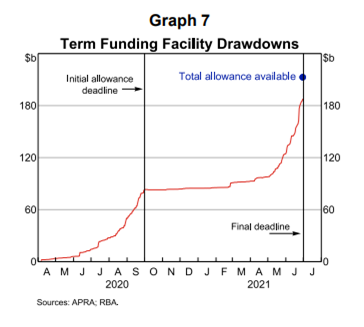

At that time, the banks had taken up just 60 per cent of their initial TFF allowances, with almost half of that occurring as late as August:

This suggested that the banks did not need TFF funding to compete for, or satisfy, the demand for borrowing from households and businesses.

Rather, the banks waited until as late as practical to draw down TFF funds because doing so extended the time the TFF would contribute to meeting regulatory liquidity requirements on the banks.

A similar pattern of late take-up was later observed with the second tranche of the TFF.

Some lessons for the future

The TFF delivered on its goals.

It lowered borrowing costs for a range of borrowers, kept credit flowing to the economy, and supported aggregate demand.

In addition, along with other measures – including the purchase of bonds in the early weeks of the pandemic – it helped to restore confidence in financial markets, which were significantly disrupted in the early days of the pandemic.

Based on the findings of the review, the Board judged that a term lending tool of this kind would be worth considering again if warranted by extreme circumstances.

But there were valuable lessons we learnt along the way that could help to shape any future program of this type.

What were those lessons?

The Latest News

-

November 16, 2024‘Chomping at the bit’: Aussie quick seizes rare chance as Pakistan targets SCG comeback – LIVE

-

November 16, 2024Aussie rules giant Zach Tuohy: ‘How could you, in all good conscience, try and stop young players doing what I did?’

-

November 16, 2024‘Slap in the face’: Stadium boss’s warning to Cricket Australia after years of tension

-

November 16, 2024AFL launches AFL Open for special needs players | Sporting News Australia

-

November 15, 2024Australian tech leaders demand reform of government ICT spending