Australia’s market sector faces job losses

- by Admin

- December 16, 2024

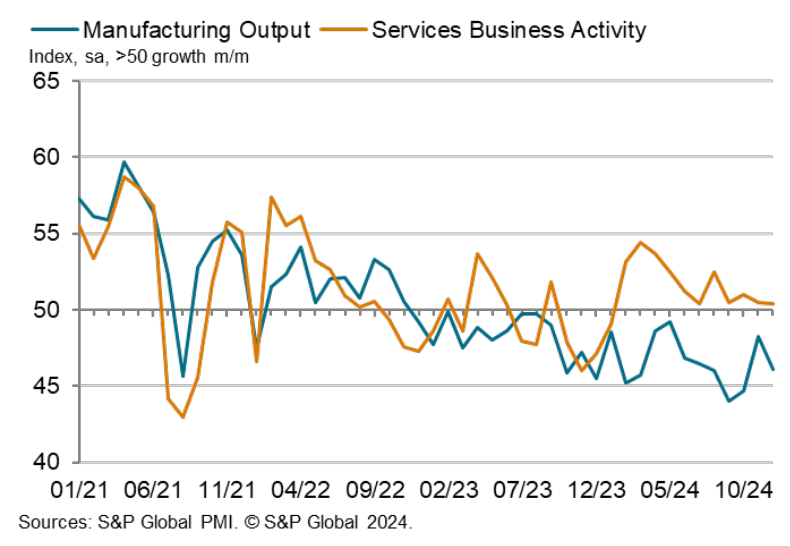

The S&P Global Flash Australia PMI has fallen to a three-month low.

According to the release:

“At 49.9 in December, the headline seasonally adjusted S&P Global Flash Australia PMI Composite Output Index was down from 50.2 in November and the lowest in three months. The index signalled that Australia’s private sector output declined marginally following two consecutive months of expansion”.

Commenting on the flash PMI data, Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence noted:

“December’s S&P Global Flash Australia PMI reflected a softening of business conditions in the final month of the year. While the smaller goods producing sector led the downturn, services activity growth notably softened to the joint-slowest recorded since the expansion streak commenced in February”.

Advertisement

“Forward-looking indicators meanwhile provided mixed signals. While business confidence climbed to the highest level in over two-and-a-half years, new business growth softened to a marginal pace and the level of unfinished work further fell”.

“Importantly, the employment gauge showed a contraction for the first time since August 2021, including in the growing service sector”.

“The softening of business conditions and muted selling price inflation are supportive of the lowering of interest rates by the Australian central bank in the new year, though rising cost pressure will need to be monitored for passthrough to selling prices in the coming months”.

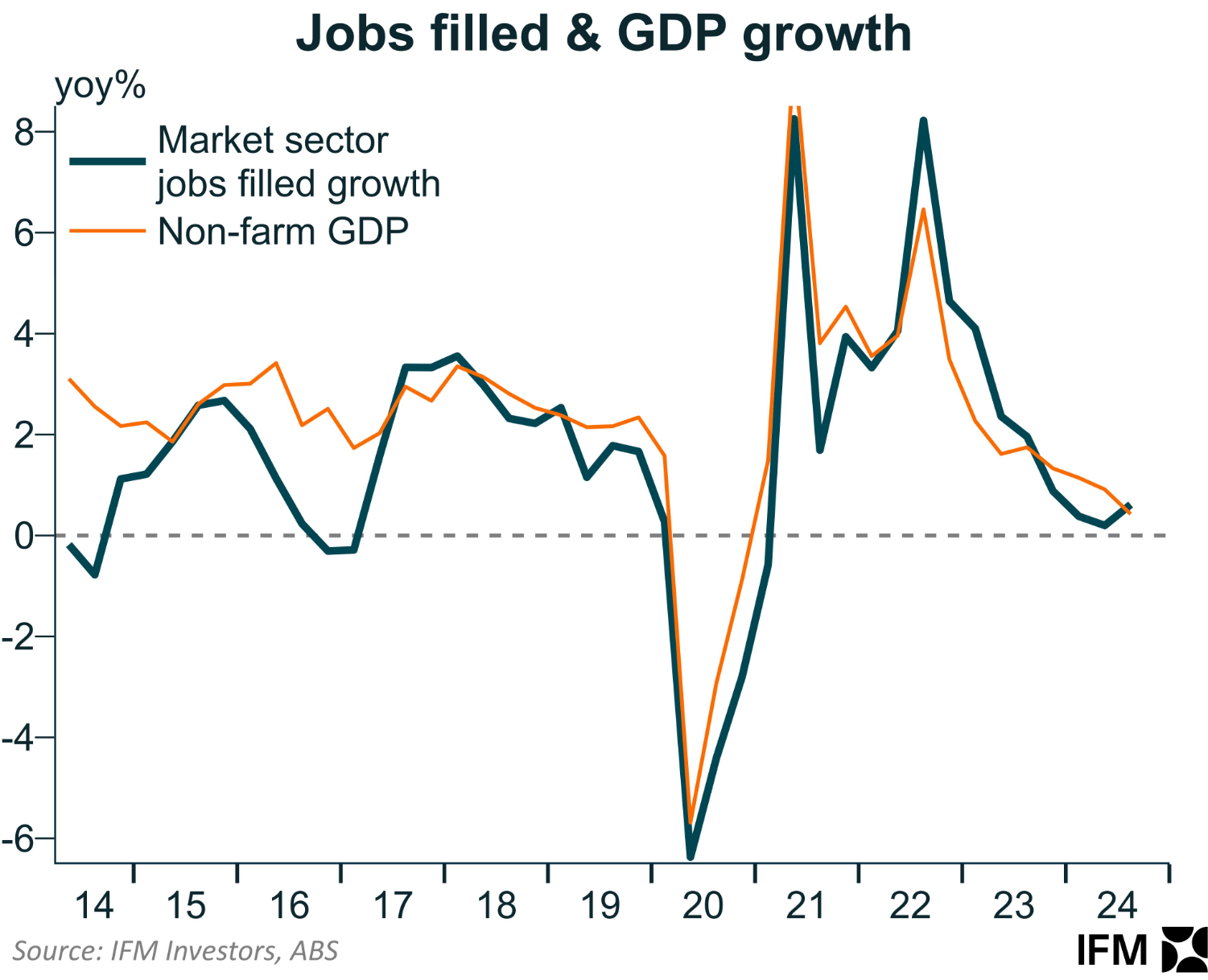

The data suggests the market sector jobs will continue to come under pressure.

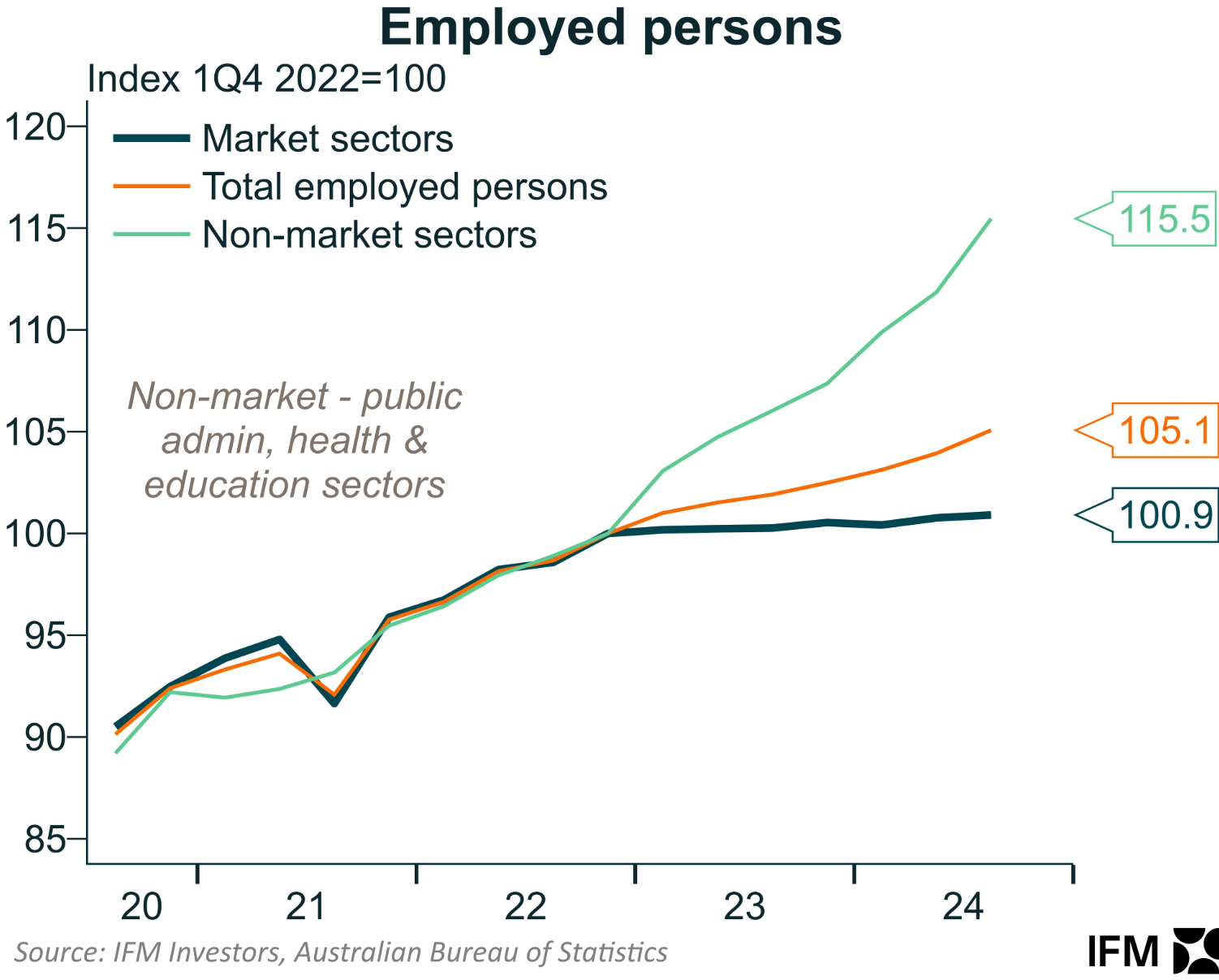

Indeed, there has been near-zero market sector job growth since the end of 2022. By contrast, non-market jobs have risen by more than 15% over the same period.

Advertisement

The Latest News

-

December 19, 2024McSweeney no guarantee for MCG as selectors consider changes for Boxing Day Test

-

December 19, 2024STOP PRESS: Green wins a second Greg Norman Medal | Inside Golf. Australia’s Most-Read Golf Magazine as named by Australian Golfers

-

December 19, 2024Ryan Peake pips David Micheluzzi in Sandbelt Invitational playoff – Australian Golf Digest

-

December 19, 2024British YouTuber and rapper Yung Filly admits to reckless driving in Australia while awaiting trial – Medicine Hat News

-

December 19, 2024Jack Draper: British No 1 voices injury fears ahead of Australian Open in Melbourne next month