Live: Nasdaq, bitcoin hit fresh records, ASX edges higher

- by Admin

- December 16, 2024

It’s not as if more fuel needed to be poured on the inferno that is the bitcoin price, but that’s exactly what happened when president-elect Donald Trump suggested the US should build crypto reserves similar its oil reserves.

“Yeah, I think so” was Mr Trump’s response to the leading question on the CNBC network late last week whether a crypto reserve was a good idea.

“We’re gonna do something great with crypto because we don’t want China or anybody else — not just China but others are embracing it — and we want to be the head,” Mr Trump continued.

Wooshka! Off went the bitcoin price again.

Remarkably, bitcoin has put on more than 50% since Mr Trump won the US presidential election a little over a month ago and is up almost 200% for the year.

“We’re in blue sky territory here,” IG market analyst Tony Sycamore, told Reuters

“The next figure the market will be looking for is $110,000. The pullback that a lot of people were waiting for just didn’t happen, because now we’ve got this news.”

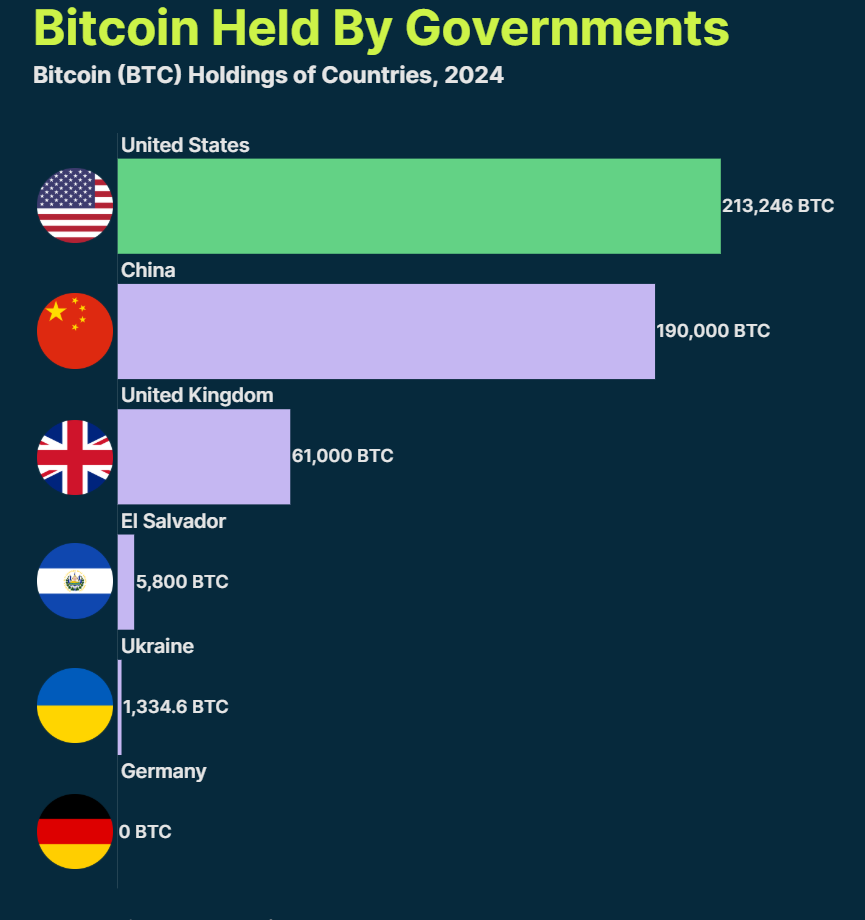

To an extent, some governments already have dabbled in holding crypto.

According to crypto data aggregator, CoinGecko, governments around the world held 2.2% of bitcoin’s total supply, or 471,380.6 BTC at the start of August.

At current prices, that’s about $US50 billion. Not massive, but a start.

“Governments are increasing their holdings of bitcoin, either by seizing them from criminal activities or donations or by actively purchasing them,” CoinGecko noted.

The US government’s stash of more than 200,000 bitcoin, currently valued at about $US22 billion received its seed funding from the shutdown and seizure of assets the black-market operator, Silk Road in 2013 — a nice little earner.

The impending regulatory light touch seems to have come a bit late for Silk Road.

Mr Trump is not the only world leader eyeing strategic reserves of bitcoin.

Russian President Vladimir Putin earlier this month said the current US administration was undermining the role of the US dollar as the reserve currency in the global economy by using it for political purposes, forcing many countries to turn to alternative assets, including cryptocurrencies.

“For example, bitcoin, who can prohibit it? No-one,” Mr Putin said.

Food for thought, right there.

It’s been an interesting conversion for Mr Trump who once famously described bitcoin as a “scam” and now wants the US to be the “crypto capital of the planet.”

He has nominated a pro-crypto Washington lawyer, Paul Atkins, to be the new head of the powerful Securities and Exchange Commission, and former Paypal executive David Sacks — a close friend and confident of Elon Musk — to head up an AI and cryptocurrency department in the new administration.

In another boost for bitcoin, the tech-centric Nasdaq exchange will add the ultra-aggressive crypto investor MicroStrategy to the Nasdaq-100 index.

As the head of research at Pepperstone Chris Weston observed, it’s more fuel for bitcoin’s surge.

“(The market was) front running the idea that Michael Saylor (MicroStrategy CEO) will capitalise on the likely rally in the MicroStrategy share price, given the impending passive flows from its inclusion into the NAS100 — where he’ll presumably sell shares and purchase more bitcoin.”

And so it goes, spiralling ever upwards — an asset that can never really be valued.

The Latest News

-

December 18, 2024Hewitt receives wildcard to join Birrell, Tomic in AO qualifying

-

December 18, 2024Australia counts the gifts and the gaffes from a very silly Gabba Test

-

December 18, 2024Rounds, memberships up as Golf Australia releases 2023-2024 participation report – Australian Golf Digest

-

December 18, 2024Australia’s bold declaration backfires as top order crumbles again

-

December 18, 2024Five quick hits: Time for a frantic collapse on a wet and wild final day at the Gabba