Exploring High Growth Tech Stocks In Australia December 2024

- by Admin

- December 24, 2024

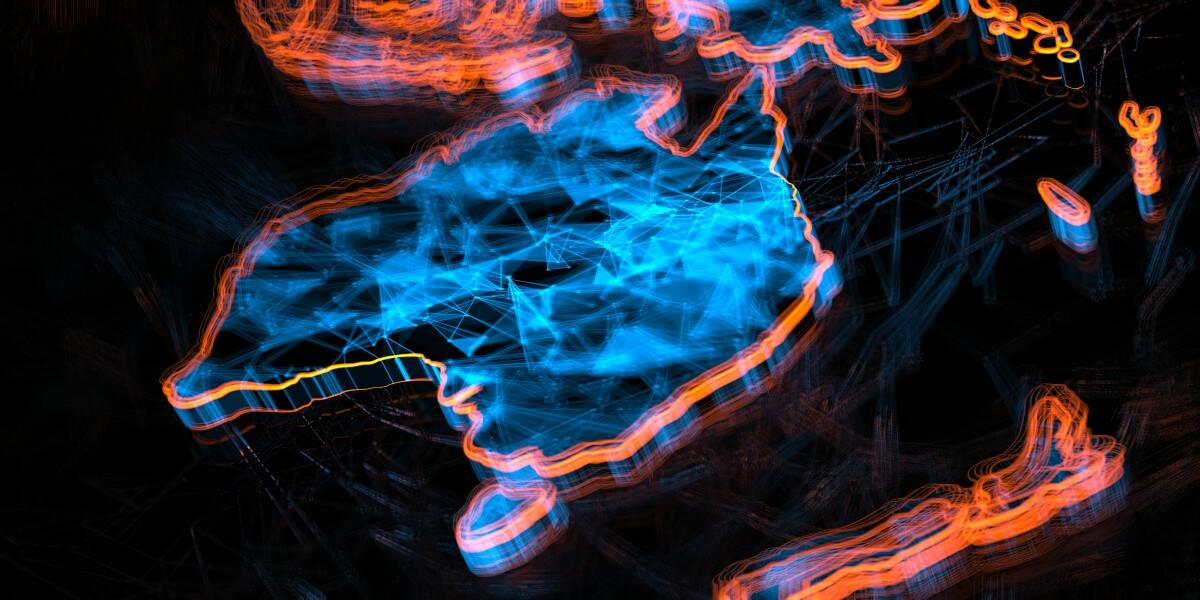

As the Australian market wraps up the year with a modest gain in the ASX 200, closing at 8,217 points, investors are keeping a close eye on economic indicators such as inflation rates that remain higher than desired by the Reserve Bank of Australia. In this environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and innovation amidst fluctuating market conditions and sector-specific challenges.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Clinuvel Pharmaceuticals |

21.38% |

26.16% |

★★★★★☆ |

|

Adherium |

86.80% |

73.66% |

★★★★★★ |

|

Telix Pharmaceuticals |

21.55% |

38.32% |

★★★★★★ |

|

ImExHS |

20.47% |

111.20% |

★★★★★★ |

|

AVA Risk Group |

25.54% |

77.32% |

★★★★★★ |

|

Pointerra |

56.62% |

126.45% |

★★★★★★ |

|

Mesoblast |

45.80% |

62.78% |

★★★★★★ |

|

Wrkr |

37.21% |

98.46% |

★★★★★★ |

|

Opthea |

52.73% |

63.45% |

★★★★★★ |

|

SiteMinder |

18.83% |

60.52% |

★★★★★☆ |

Click here to see the full list of 61 stocks from our ASX High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.01 billion.

Operations: The company’s primary revenue stream comes from its role as a value-added IT reseller and IT solutions provider, generating A$805.75 million. The business focuses on delivering comprehensive IT services across Australia, Fiji, and the Pacific Islands.

Data#3, a notable entity in Australia’s tech landscape, is demonstrating robust growth dynamics, with revenue expected to surge by 23.8% annually, outpacing the broader Australian market’s 5.8%. This growth is complemented by an earnings increase of 17% over the past year, although its projected annual earnings growth of 9.6% slightly trails the national average of 12.5%. The recent appointment of Bronwyn Morris to its board underscores a strategic bolstering in governance that could enhance corporate oversight and risk management strategies. Moreover, Data#3’s commitment to innovation is evident from its significant R&D investment relative to revenue, ensuring it remains at the forefront of technological advancements and maintains competitive advantage within the IT sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Iress Limited designs and develops software and services for the financial services industry across the Asia Pacific, United Kingdom, Europe, Africa, and North America, with a market cap of A$1.70 billion.

The Latest News

-

December 25, 2024Warne, Tendulkar, Muralitharan and (even) Gladstone Small: Eleven Boxing Day Test memories

-

December 25, 2024‘Stops riots outside the Members Stand’: Aussie skipper backs cult hero for big MCG return

-

December 25, 2024India vs Australia fourth Test: Cummins & Co. hope to restrict Rohit’s men in Melbourne

-

December 25, 2024Sam Konstas is the right player at the right time for Australia. Here’s why

-

December 25, 2024Christmas at the ‘G! Aussie stars and family lap up big day