ASX falls as higher inflation pushes back rate cut bets, BHP seeks Anglo American takeover extension — as it happened

- by Admin

- May 28, 2024

Why is the current interest rate setting called “restrictive”? It’s clearly not restrictive as inflation is climbing. And whilst I know some people are struggling, a quick look around the packed restaurants, bars and cafes in my city shows many are not. I think the RBA needs to raise rates again, especially with electricity rebates and tax cuts around the corner.

– John Curral

Hi John, I have to disagree with your observations.

Yes, inflation is climbing, but prices aren’t rising nearly as fast (and in some cases are falling outright) for discretionary goods and services.

For example, the cost of furnishings, household equipment and services has dropped 0.8% over the past year.

Recreation and culture prices are down 1.3%, driven by a 6.2% drop in the cost of holiday travel and accommodation (post-Easter).

Yesterday’s retail sales figures showed turnover rose just 0.1% last month, despite the uplift from both inflation and population growth.

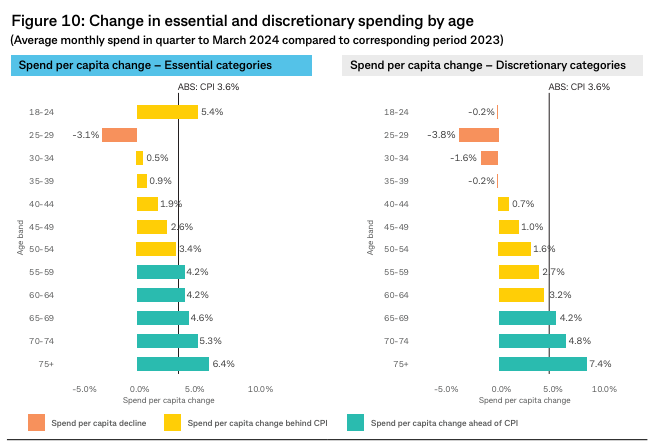

Figures based on actual consumer spending data from Commonwealth Bank customers shows the skew of spending towards essentials over things we’d like but don’t need.

And there’s a clear two-speed economy going on. But this time it’s not so much east versus west as in the earlier 2000s, it’s young versus older.

No doubt, some restaurants, cafes and bars are packed some of the time in some cities, but a lot are really struggling in other areas, particularly those serving a younger demographic.

My colleague Emilia Terzon did a great piece on this a couple of months ago.

As RBA governor Michele Bullock said at her last press conference, the bank may have to keep hammering already struggling areas of the economy with higher rates to make up for price rises in those parts of the economy where rates have little direct effect.

But, as I wrote after that press conference, that doesn’t seem to be a particularly efficient method of macroeconomic management.

The Latest News

-

December 23, 2024Wimbledon champion accepts ban for anti-doping breach just months after winning US Open

-

December 23, 2024Australian tennis star Purcell takes voluntary suspension over anti-doping breach

-

December 23, 2024Max Purcell to miss Australian Open after accepting ban for anti-doping breach

-

December 23, 2024Australian tennis star Purcell provisionally suspended for doping

-

December 23, 2024Star batter misses optional Aussie session; MCG curator rejects anti-India ‘conspiracy’ — Test Daily