Australia Buy Now Pay Later Business Report 2024-2029: Innovative BNPL Startups are Entering the Market to Tap into High-growth Market

- by Admin

- August 21, 2024

Australian Buy Now Pay Later Market

Dublin, Aug. 21, 2024 (GLOBE NEWSWIRE) — The “Australia Buy Now Pay Later Business and Investment Opportunities Databook – 75+ KPIs on BNPL Market Size, End-Use Sectors, Market Share, Product Analysis, Business Model, Demographics – Q1 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

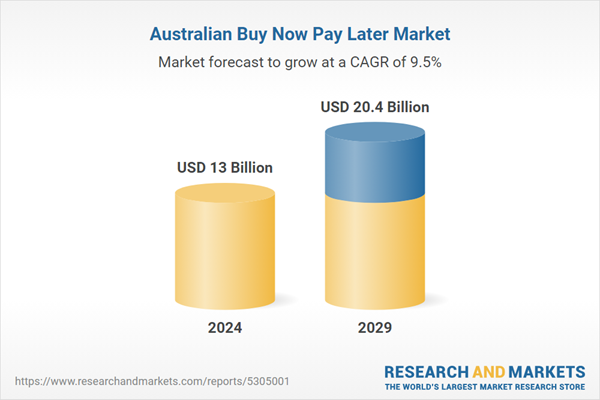

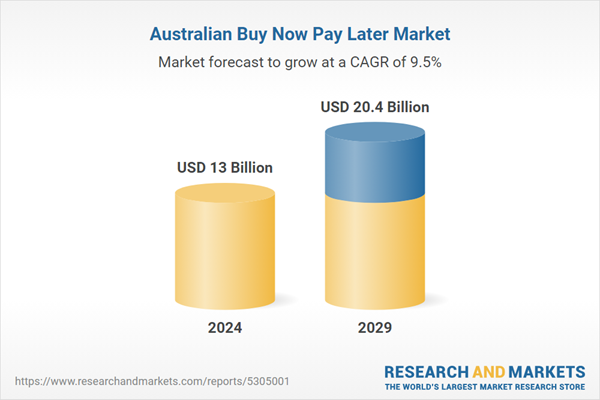

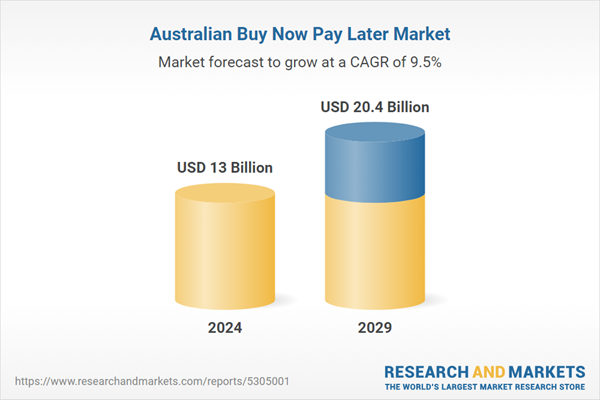

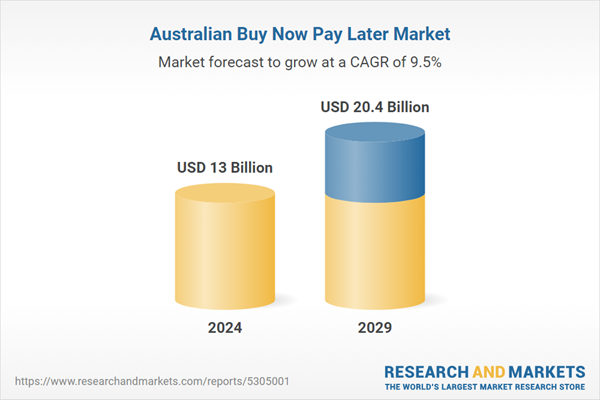

BNPL payments are expected to grow by 14.7% on an annual basis to reach US$ 12.95 billion in 2024.

The medium to long-term growth story of the BNPL industry in the country remains strong. BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 9.5% during 2024-2029. The BNPL gross merchandise value in the country will increase from US$ 11.29 billion in 2023 to reach US$ 20.39 billion by 2029.

This report provides a detailed data-centric analysis of the Buy Now Pay Later (BNPL) industry, covering market opportunities and risks across a range of retail categories. With over 75 KPIs at the country level, this report provides a comprehensive understanding of BNPL market dynamics, market size and forecast, and market share statistics.

The buy now pay later industry is projected to grow at a steady pace over the medium term in Australia. Inflation continues to drive more shoppers towards flexible payment schemes offered by BNPL providers. The trend is much higher among young generation shoppers in the Australian market. In 2024, the publisher expects more players to enter the market with their innovative products.

This will drive the competitive landscape in the sector over the next 12 months. To competition, existing providers are launching new features and services through strategic partnerships. Firms are also expected to raise venture capital and private equity funding over the medium term. Overall, the publisher maintains a positive growth outlook for the buy now pay later industry in Australia over the next three to four years.

The adoption of buy now pay later schemes is rising among young generation Australian shoppers

With high inflation and interest rates eating into the disposable income of many across the country, the use of buy now pay later schemes has been on the surge over the last few quarters. The trend is especially growing among young generation shoppers, who are using the payment method for groceries and other essentials.

The report from the Reserve Bank of Australia revealed that 40% of shoppers, aged 18 to 39, are using the buy now pay later schemes in Australia. The report also revealed that a third of Australians, aged 18 and above, have used the payment method in the last 12 months, leading up to November 2023. While a few are using the BNPL method for luxury purchases, the majority are using it for essentials and as a vital financial management tool.

The publisher expects the adoption of buy now pay later solutions to increase further in the Australian market over the medium term. This will support the growth of the industry over the next three to four years.

BNPL firms are forging strategic alliances to provide targeted offers to shoppers at checkout

To provide e-commerce shoppers with more relevant offers at checkout, while targeting higher gross merchandise volume, BNPL firms are entering into strategic partnerships in the Australian market.

-

Afterpay, one of the leading Australian BNPL firms and a subsidiary of Block, announced a strategic partnership with Rokt, an e-commerce technology firm. As part of the collaboration, Afterpay aims to expand its ads business, while offering relevant offers to e-commerce shoppers at the checkout.

-

Rokt, notably, makes use of machine learning and artificial intelligence to make transactions more personalized for e-commerce shoppers. Consequently, by leveraging the technical capabilities offered by Rokt, Afterpay aims to enhance the overall shopping experience for its users.

Afterpay, in another strategic partnership, joined forces with the Nift Network to enhance its service by launching a rewards program. In this collaboration, Nift’s artificial intelligence technology is used to match Afterpay customers with a carefully chosen assortment of gifts from the 12,000 brands featured on the Nift Network. Going forward, the publisher expects Afterpay to forge more such partnerships, enhancing shoppers’ experience and aiding business growth.

Innovative BNPL startups are entering the market to tap into high-growth Australian market

With robust demand for BNPL solutions and the market poised for steady growth over the next three to four years, new startups are entering the market with their innovative products in Australia.

-

AtPay, a BNPL service utilizing decentralized finance (DeFi), is gearing up for a soft launch in Australia. AtPay supports payments in both traditional currency and cryptocurrency, both online and in physical stores. Users earn AtPay tokens with each repayment, which can be redeemed with the firm’s partner merchants.

-

To facilitate card issuance, AtPay has chosen Pismo, a core banking platform based in Sao Paulo, Brazil. Pismo, recently acquired by Visa, offers services such as debit, credit, tokenized, and prepaid cards through an API. AtPay plans to launch officially in Australia in Q1 2024, with ambitions to expand into international markets like the Gulf Cooperation Council (GCC) and North America over the medium term.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

88 |

|

Forecast Period |

2024 – 2029 |

|

Estimated Market Value (USD) in 2024 |

$13 Billion |

|

Forecasted Market Value (USD) by 2029 |

$20.4 Billion |

|

Compound Annual Growth Rate |

9.5% |

|

Regions Covered |

Australia |

Scope

Australia BNPL Market Size and Spending Pattern, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later Revenue Analysis, 2020-2029

-

Buy Now Pay Later Revenues

-

Buy Now Pay Later Share by Revenue Segments

-

Buy Now Pay Later Revenue by Merchant Commission

-

Buy Now Pay Later Revenue by Missed Payment Fee Revenue

-

Buy Now Pay Later Revenue by Pay Now & Other Income

Australia Buy Now Pay Later Operational KPIs & Statistics, 2020-2029

Australia BNPL by Purpose, 2020-2029

Australia BNPL by Business Model, 2020-2029

Australia BNPL by Merchant Ecosystem, 2020-2029

-

Open Loop System

-

Closed Loop System

Australia BNPL by Distribution Model Analysis, 2020-2029

Australia BNPL Analysis by Channel, 2020-2029

-

Online Channel

-

POS Channel

Australia Buy Now Pay Later in Retail Shopping: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Home Improvement: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Travel: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Media and Entertainment: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Services: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Automotive: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Healthcare and Wellness: Market Size and Forecast, 2020-2029

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later in Others: Market Size and Forecast

-

Gross Merchandise Value Trend Analysis

-

Average Value Per Transaction Trend Analysis

-

Transaction Volume Trend Analysis

Australia Buy Now Pay Later Analysis by Consumer Attitude and Behaviour

For more information about this report visit https://www.researchandmarkets.com/r/obx2ax

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

The Latest News

-

December 25, 2024Australia to bat first at MCG in Boxing Day heat

-

December 25, 2024Golf Participation in Australia Hits New Heights – APGC

-

December 25, 2024Boxing Day Test: Australia batting first against India

-

December 25, 2024Live: Fearless Konstas makes wild start to Test debut as Australia bats first at MCG

-

December 25, 2024Boxing Day Test 2024: Australia vs India fourth men’s cricket Test, day one – live updates