Australia’s inflation dragon has been slain

- by Admin

- May 17, 2024

In the latest Treasury of Common Sense with Radio 2GB’s Clinton Maynard, I discussed the band-aid federal budget, why net overseas migration numbers will overshoot projections, and why Australia’s inflation dragon has been slain.

Below are the highlights pertaining to the inflation discussion.

Clinton Maynard:

Do you think inflation has been beaten? Have we broken the back of inflation?

Leith van Onselen:

Advertisement

I honestly think we have. We had the shocker CPI inflation data for the March quarter a couple of weeks ago, which had lots of economists tipping rate hikes.

But since then, pretty much every data point that has come out has been very soft.

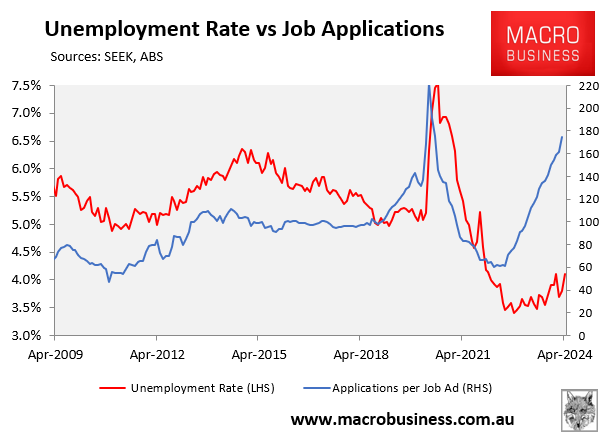

I mentioned last week that Seek’s applications per job ad series rocketed nearly 60% above pre-pandemic levels.

Advertisement

This basically means that we have lots of people applying for jobs but not enough jobs to go around.

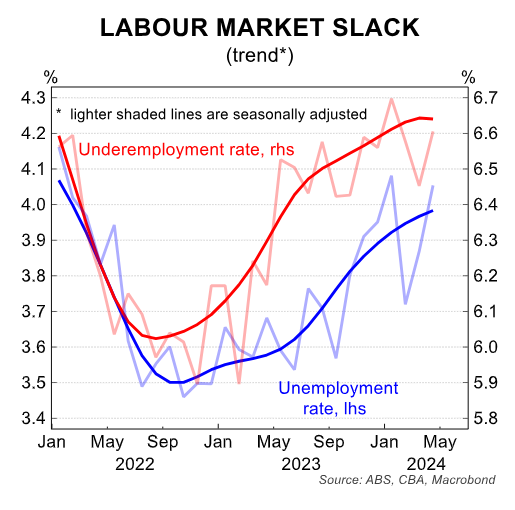

The worse-than-expected April unemployment numbers released this week confirmed this.

Advertisement

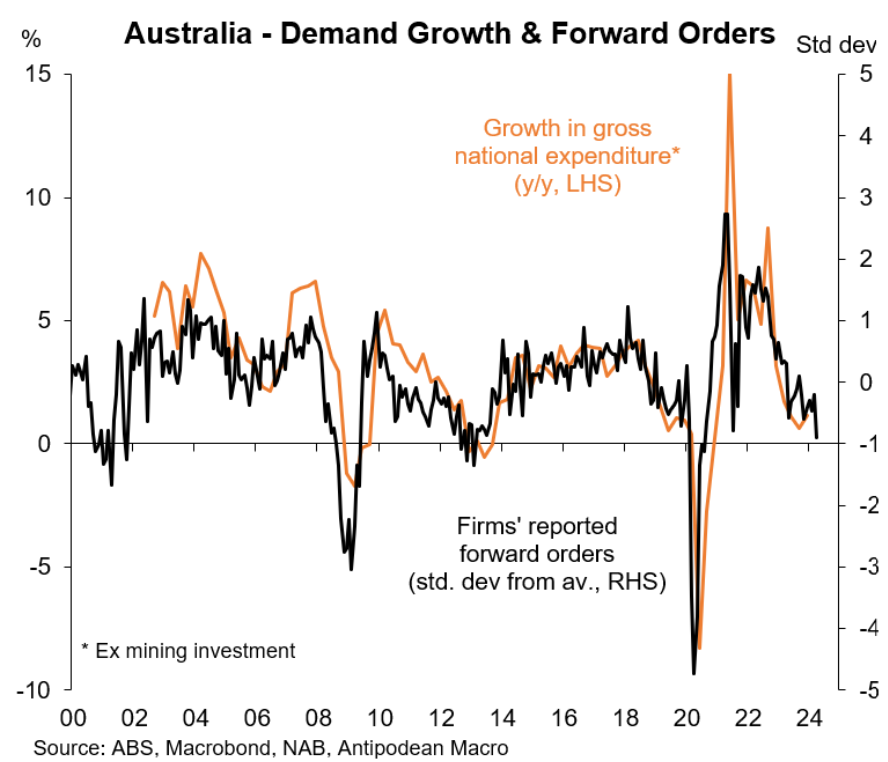

NAB’s business survey was also released and it recorded slowing economic activity, slower jobs growth, lower labour costs and lower inflation.

Advertisement

NAB’s business survey survey suggested that Australia’s per capita recession has deepened.

That’s not a good thing overall, but it’s good news for inflation.

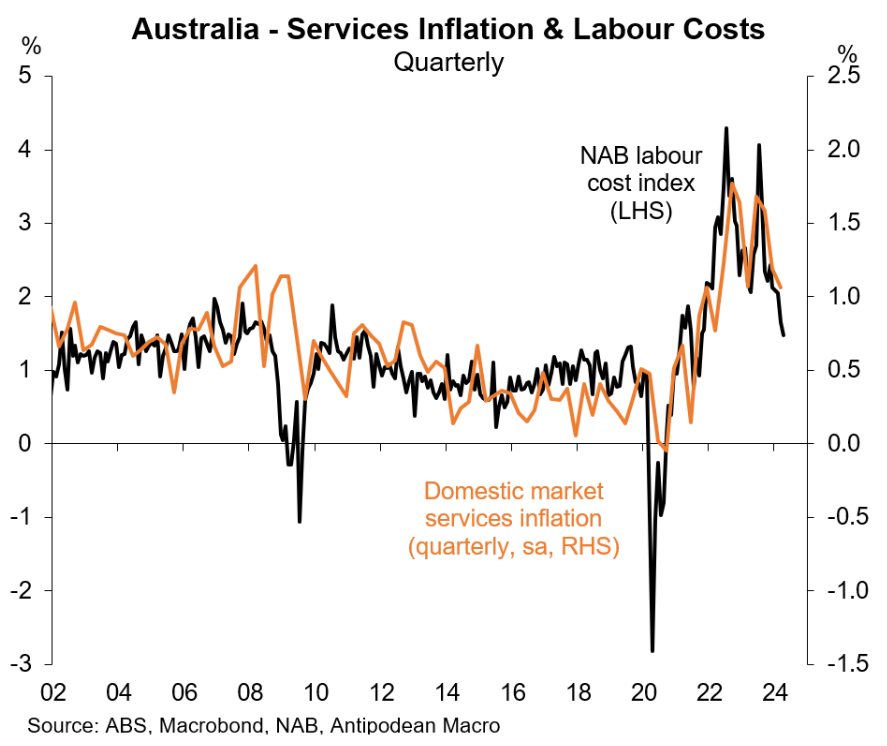

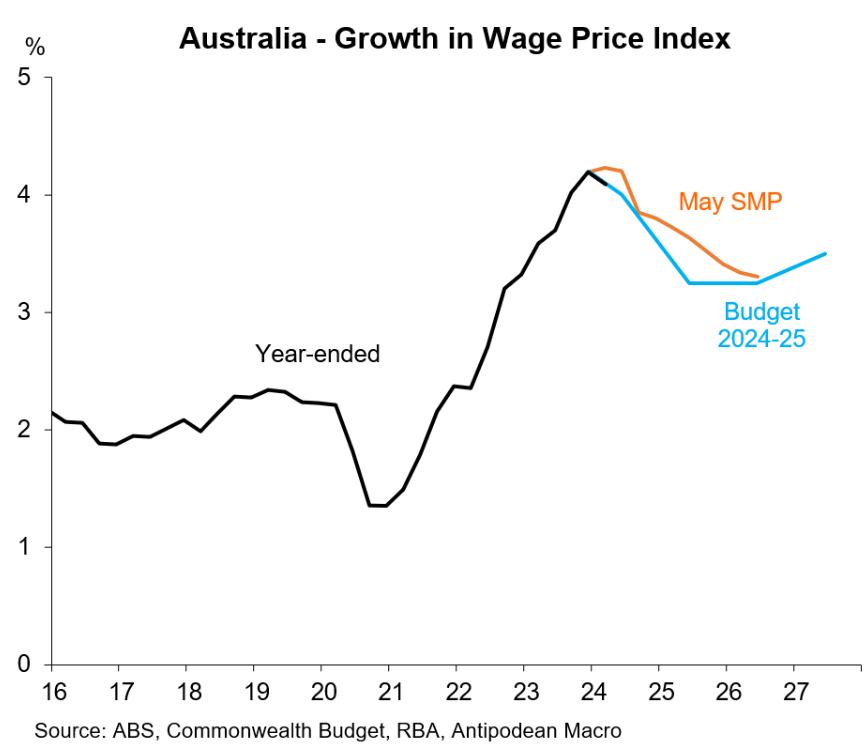

On Wednesday, the ABS wage price index for the March quarter showed that wages grew by only 8% over the quarter, which was below both the RBA’s and economists’ expectations.

Advertisement

March quarter wage growth was only 3.2% annualised. While that’s good for inflation, it’s not good for workers.

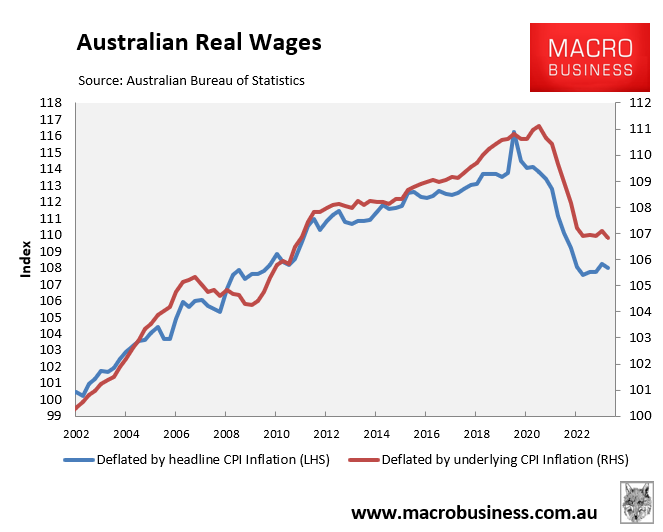

Because wage growth in the March quarter was actually lower than headline CPI inflation of 1% and lower than underlying CPI inflation of 1.1%.

Advertisement

What this means is that Australian real wages are falling once again. And they are actually 7.1% below that June 2020 peak level.

So, this is just another example of of workers getting smashed.

Advertisement

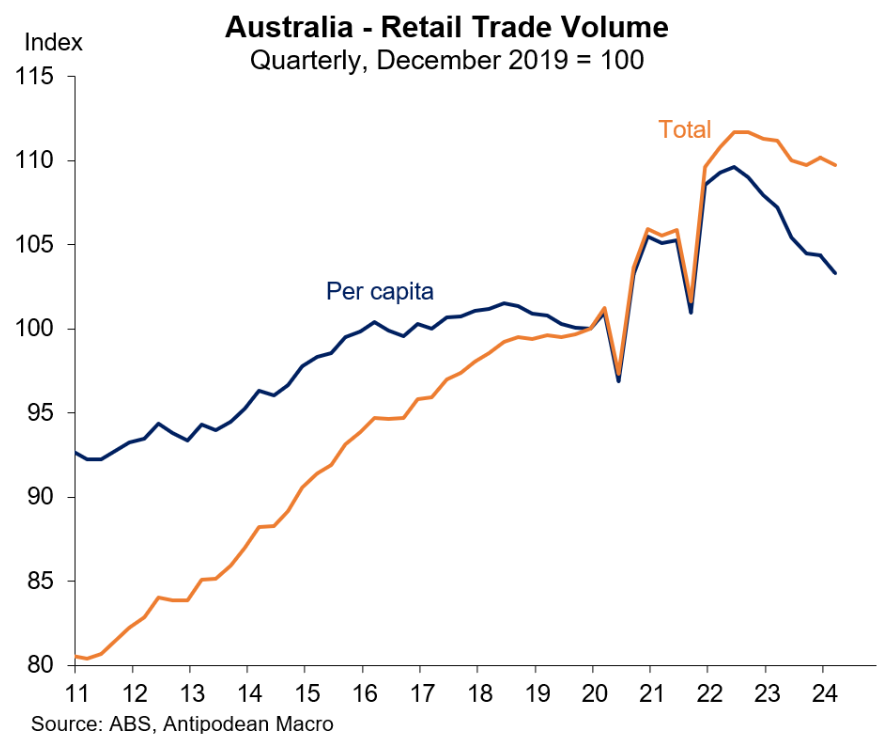

And then we had last week’s retail sales data, which showed that real per capita retail sales have fallen about 6% since mid-2022.

So, pretty much all the data is really soft at the moment. And it paints a picture of a really weak domestic economy, falling real wage growth, and rising unemployment.

Advertisement

I think for those sorts of reasons, the Reserve Bank is not going to hike again and the next move in interest rates is going to be down.

So, it’s good news on that front but not obviously for good reasons.

It means the economy is worsening and that is not so good for workers.

Advertisement

The Latest News

-

December 23, 2024‘See-ball, hit-ball’: Sam Konstas to put pressure on Jasprit Bumrah in Boxing Day Test

-

December 23, 2024Alex de Minaur makes Christmas Day pledge: ‘Never satisfied’

-

December 23, 2024News Corp. and Australia Telecom Company Telstra Agree to Sell Foxtel to Streaming Sports Platform DAZN in $2.1B Deal

-

December 23, 2024Alex de Minaur is coming off the ‘best year’ of his career… but he wants more in 2025

-

December 23, 2024Sorry, Charlie. Son of Tiger makes his first career ace, but Team Woods loses to Team Langer on first playoff hole – Australian Golf Digest