Australia’s jobs market “cracking”

- by Admin

- May 16, 2024

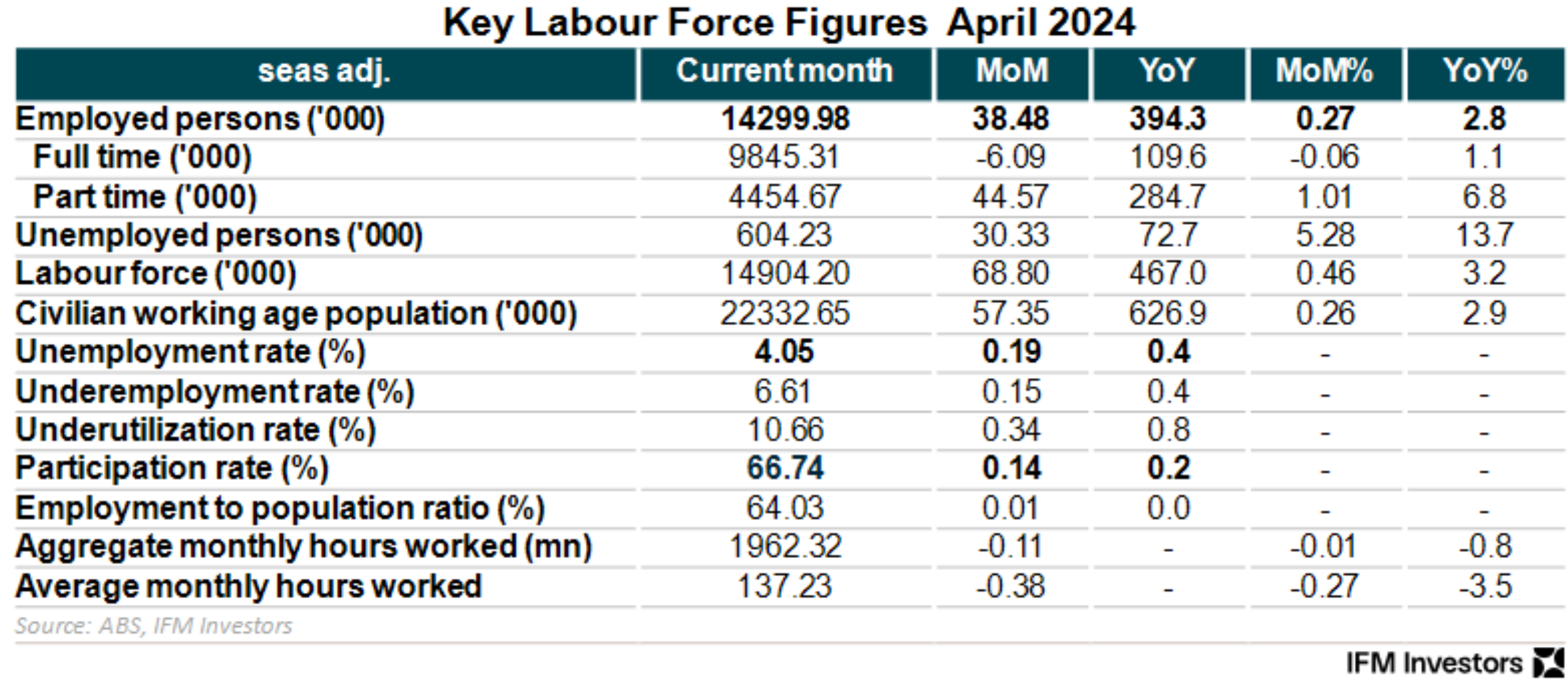

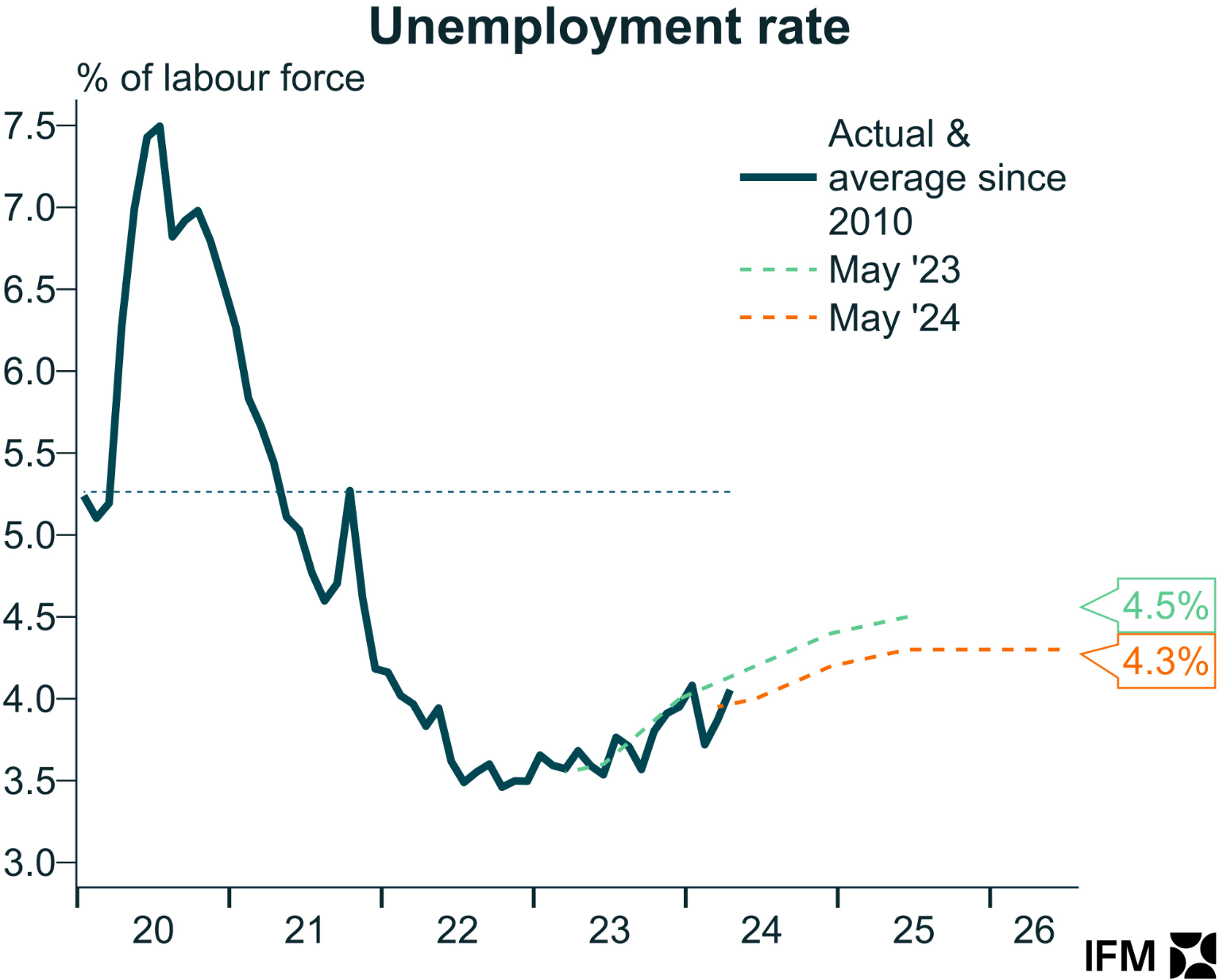

The Australian Bureau of Statistics (ABS) today released its Labour Force report for April, which recorded a 0.19% rise in the unemployment rate to 4.05% alongside a 0.15% rise in the underemployment rate to 6.61%:

The result was far worse than economists’ expectations of a 3.9% unemployment print.

The result came amid a solid 38,480 rise in jobs (all part-time) and a 0.14% rise in the participation rate.

Advertisement

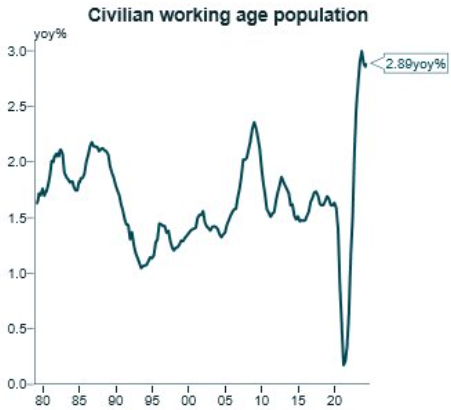

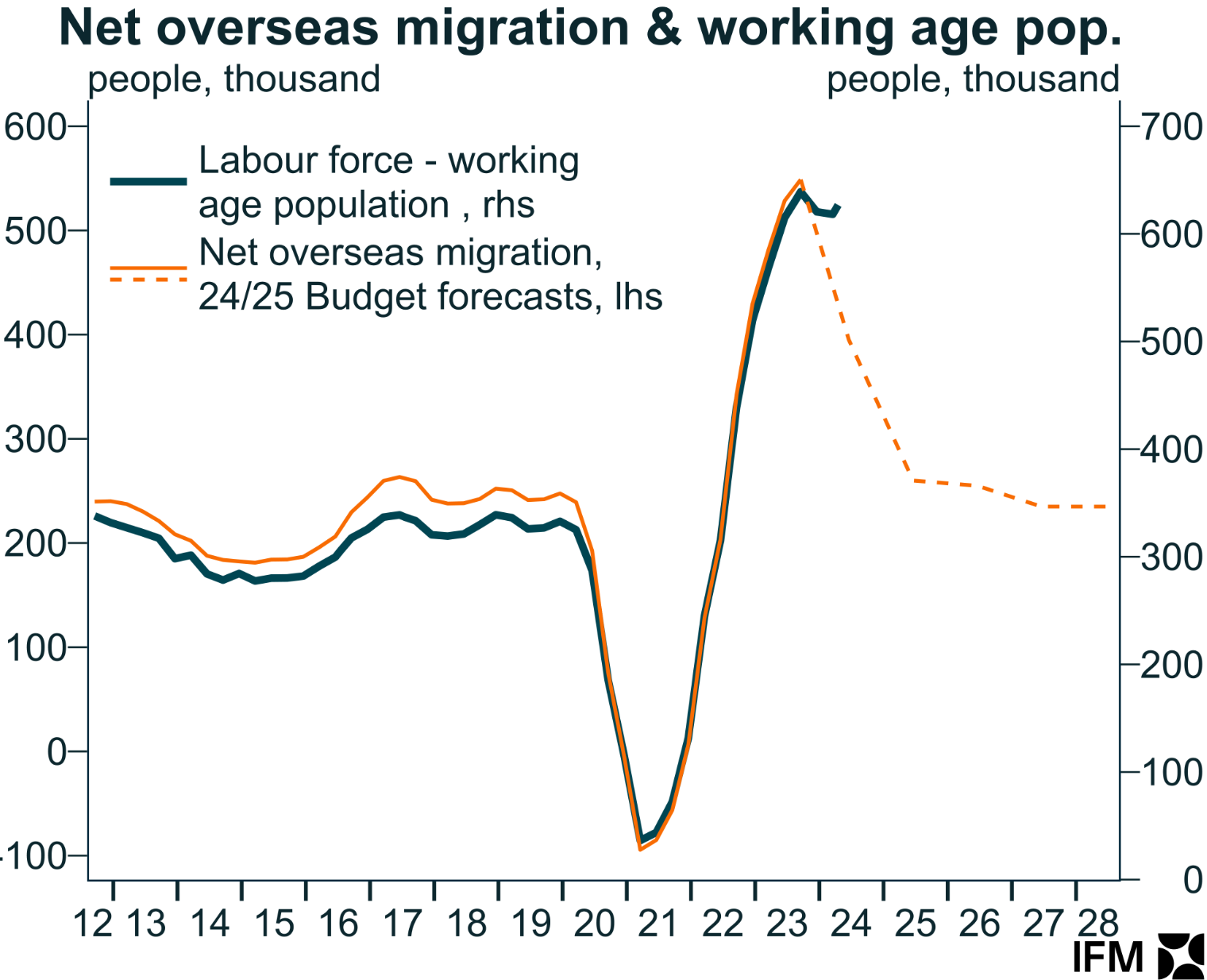

The biggest driver of the rising unemployment and underemployment rates is Australia’s surging labour supply, which has been driven by record net overseas migration:

Source: Alex Joiner

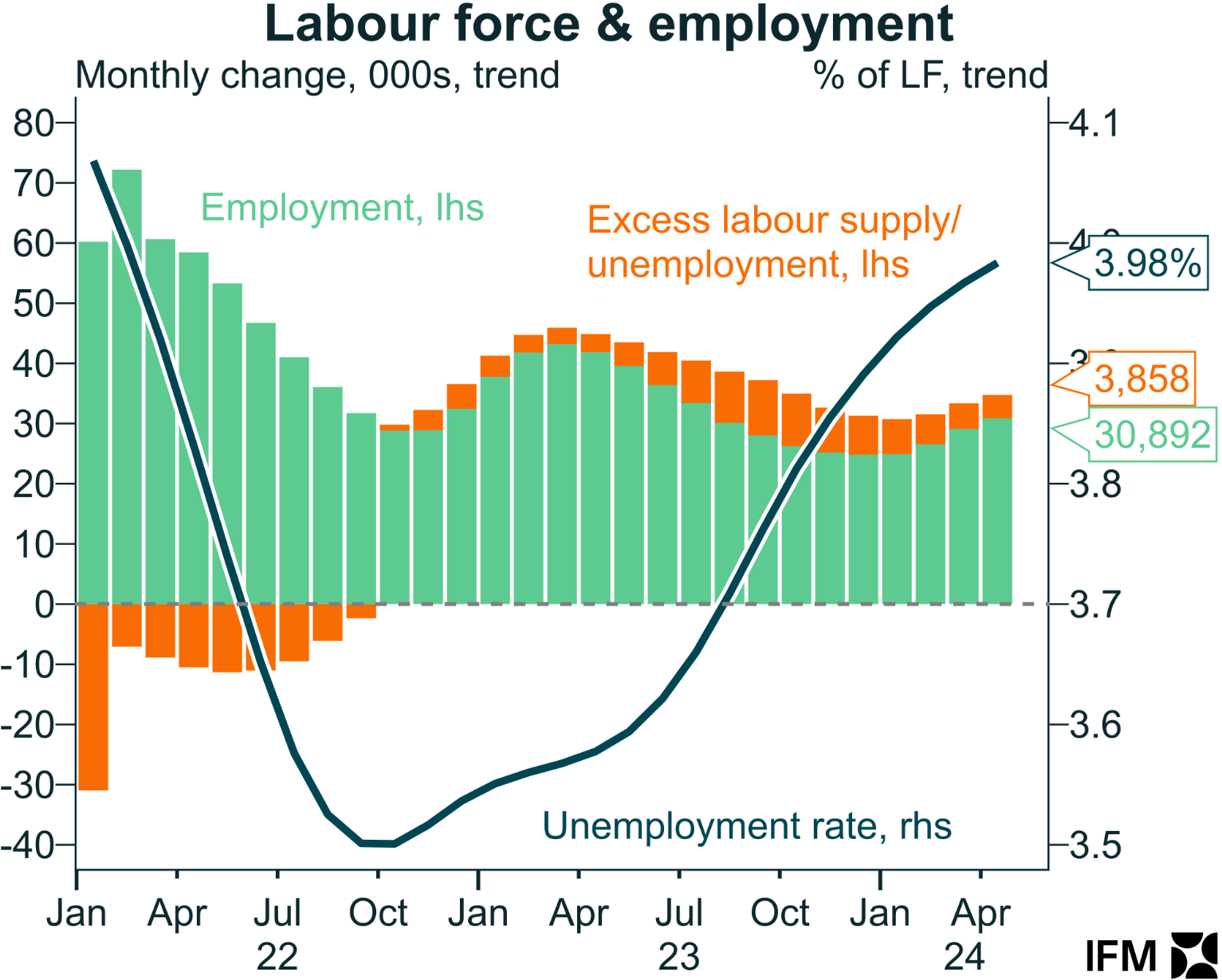

Alex Joiner, chief economist at IFM Investors, noted that there is “still solid employment growth but even stronger labour supply, resulting in the grind higher of the unemployment rate”:

Advertisement

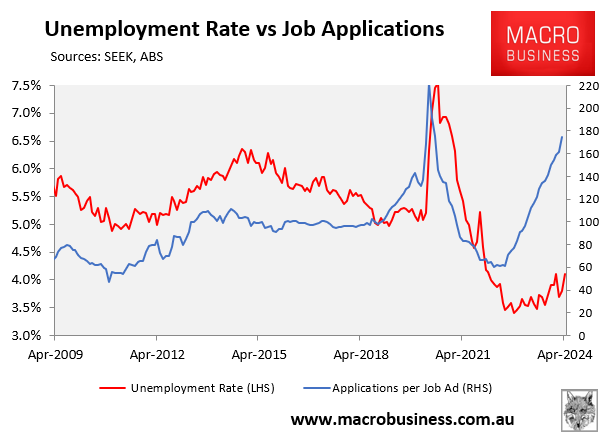

This is also illustrated clearly by the explosion in the number of applicants per job ad reported by Seek:

Advertisement

Hopefully, the federal budget’s lower migration forecasts will come to fruition, slowing the flow of new workers:

Importantly, the official unemployment rate is now “perilously close to the peak in the RBA’s forecast of 4.3%”, notes Joiner.

Advertisement

“If the RBA is wanting to hold on to labour market gains as it says, it’s not going to hike lightly”:

When viewed alongside Wednesday’s weaker than expected wage growth in Q1 reported by the ABS, Moody’s Analytics warned that “cracks are emerging” in Australia’s labour market:

Advertisement

“Cracks are emerging in the Aussie labour market. For more than four years, jobs have been a shield for Aussie families, refusing to baulk at pressures from the pandemic, war, inflation and interest rates. But those pressures are starting to take a toll”…

“The market is no doubt softening and will continue to do so from here”.

“The weak print comes on the heels of data showing an easing of wage growth across the first quarter of the year”…

“We expect unemployment to edge higher over the next 12 months. Job vacancies are moving lower and hiring intentions have softened”..

“With labour supply winning the race over new job creation, unemployment is on track to hit 4.35% by December and 4.5% by the middle of next year”.

Anybody still arguing for rate hikes needs their head read.

The Latest News

-

December 23, 2024‘See-ball, hit-ball’: Sam Konstas to put pressure on Jasprit Bumrah in Boxing Day Test

-

December 23, 2024Alex de Minaur makes Christmas Day pledge: ‘Never satisfied’

-

December 23, 2024News Corp. and Australia Telecom Company Telstra Agree to Sell Foxtel to Streaming Sports Platform DAZN in $2.1B Deal

-

December 23, 2024Alex de Minaur is coming off the ‘best year’ of his career… but he wants more in 2025

-

December 23, 2024Sorry, Charlie. Son of Tiger makes his first career ace, but Team Woods loses to Team Langer on first playoff hole – Australian Golf Digest