CFOs Are More Involved Than Ever in Australia and New Zealand Technology Decisions

- by Admin

- August 5, 2024

CFOs are taking a more assertive role in IT decisions in Australia and New Zealand in 2024.

Research from enterprise software solutions firm Rimini Street shows that CFOs are now often the ones guiding underlying technology decisions — a responsibility traditionally held by company CIO’s.

The research, C-Suite Imperatives: Evolving IT and Enterprise Investments, surveyed 250 CFOs and CIOs in the ANZ region. It revealed that closer collaboration is improving CFO and CIO relationships, which could result in higher IT budgets and business return on investment.

Up to 70% of technology decisions involve CFOs in 2024

CIOs once had primary responsibility for the tech decisions made by enterprises. However, Rimini Street’s research found 60% of CFOs say they are the ones responsible for underlying technology decisions to achieve business results, marking a shift in how decisions are made.

Specialist IT research firm ADAPT Research has also noted this trend. ADAPT’s strategic research director, Matt Boon, estimated at a recent Sydney conference that CFOs are now involved in 70% of all IT investment decisions. He said this level was “the highest we’ve ever seen.”

CFOs aren’t the only ones who notice this shift. CIOs agree that their CFO counterparts are the ones making the underlying technology decisions and taking the lead role in setting technology investment budget levels.

Why are CFOs more involved in technology decisions?

The increased focus on financials in Australia and New Zealand is no secret. The market has seen rising inflation, higher interest rates and slower business growth. IT leaders in the region have been under pressure to do more with the same or less or face slower budget increases.

Resource: How CFOs have evolved from number crunchers to value drivers

The environment has drawn CFOs closer into technology oversight and decision-making. CFOs have been concerned about cost, as elements like rising cloud costs impact the bottom line. They are also interested in the contribution technology investments make to business growth.

CFOs lament lack of connection with business goals

The Rimini Street report showed that only 23% of CFOs are happy with the impact tech investments are making on their business goals — a major reason why they’re more involved in tech decisions. That leaves about 3 in 4 CFOs who aren’t completely pleased with the results of their legacy tech investments or who don’t think that IT investments are tied to business goals.

In fact, many CFOs have scathing feedback when asked about organisational technology. Among surveyed CFOs:

- 29% have seen only mixed results from tech investments, when measured against achieving desired business outcomes or gaining sufficient long-term value.

- 19% say they often see a negative impact from technology investments, including ongoing costs, limited future flexibility or business disruption.

- 17% surveyed by Censuswide for Rimini Street say that most of the organisation’s technology investments are not tied to their business goals.

- 12% have seen little or no business improvement from their technology investments, and/or the cost of the investment outweighed the value of the improvement.

Stronger CFO and CIOs relationships are benefiting businesses

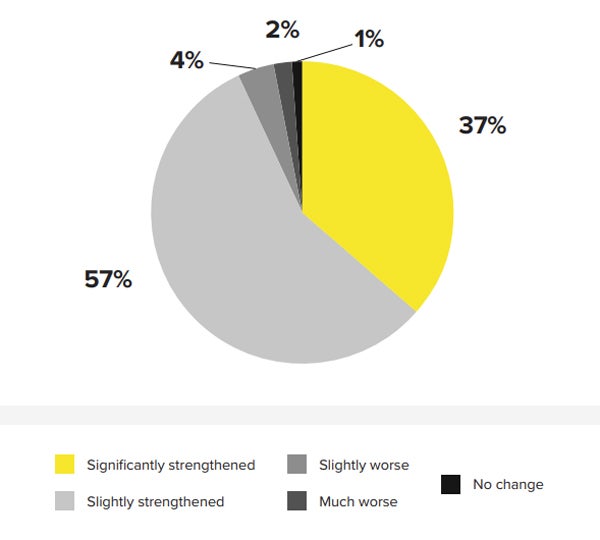

Despite some CFO dissatisfaction, 94% of respondents said the CFO and CIO relationship has strengthened significantly or slightly. This is a large percentage considering the CFO is increasingly encroaching on some of a CIO’s traditional responsibilities.

CFOs seeing CIOs in a more positive light

Closer collaboration is tipping CFO perception of CIOs toward the positive. The survey found:

- 39% of CFOs considered their CIO as an “innovative change-agent who drives business strategy.”

- 33% see their CIOs as partners who help connect the dots between tech and business decisions.

Rimini Street said these skill sets go beyond the core technology strength of most IT execs.

“It speaks to leadership and collaboration more so than technology proficiency, indicating at least on the CIO side, they are learning the CFO’s language,” according to the report.

Why the CFO-CIO bond is growing stronger

An uncertain business environment has been a factor in the strengthening relationship between CFOs and CIOs, as they have been required to work closely together. According to the Rimini report, some of the reasons nominated by CIOs and CFOs for the stronger bond were:

- The other leader proactively engaging (39%).

- A focus on security, compliance and risk (38%).

- The urgent need to collaborate to make nimble technology decisions (37%).

- The need to quickly cut IT costs in a smart way (35%).

Rimini Street said CFOs remain dependent on CIOs because of the complexity of IT decisions and want CIO guidance with priorities rooted in technology, such as security and emerging technologies. CIOs are looking to CFOs to assist them with budget and executive advocacy.

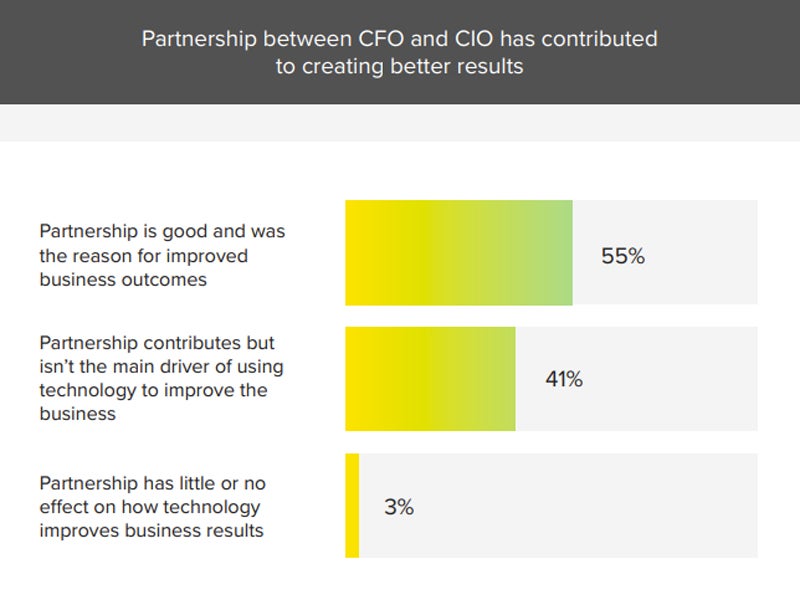

CFOs believe closer collaboration with CIO is good for business

More than half of CFOs in the ANZ region (55%) believe a positive CFO-CIO relationship has been instrumental to better business outcomes. A significant 41% think the partnership contributes, even if it’s not the main driver of improving business results.

CFO and CIO business relationships still have room to improve

The CFO and CIO relationship can still improve. For example, both CFOs and CIOs think the other should better understand their discipline:

- A large percentage of CFOs (91%) indicated that their CIO counterpart needs to be more business-savvy to better communicate with them.

- A combined 96% of CIO respondents indicated their CFO counterpart needs to be more technology-savvy to improve communication with them.

Why CFO and CIO relationships go bad

A small percentage (6%) of CFOs report having a worse relationship with their CIO. Among these CFOs, 38% attributed the issue to a lack of expertise in addressing security, compliance and risk issues, while another 38% cited the CIO’s inflexibility in identifying ways to cut IT costs.

Other reasons for CFO dissatisfaction included CIOs demonstrating a frustrating lack of urgency (23%), presenting plans that did not demonstrate adequate return on investment (23%), or not welcoming more proactive engagement (23%). These issues indicate that both skills and working styles could both be relationship flashpoints.

How IT leaders can better engage with their CFOs

Savvy IT leaders have the potential to better leverage blossoming CFO relationships to advance the interests of IT within the organisation — particularly when it comes to budgets and investment.

Get used to working more closely with CFOs

IT budgets are expanding as a percentage of overall revenue, with 79% of respondents to Rimini Street’s report saying they are increasing. As IT balloons in importance, both in terms of cost and as a business-value driver, CIOs should expect increased involvement and scrutiny from CFOs.

SEE: Four proven ways to expand your value as a CIO in 2024

Rimini Street added that CFO dissatisfaction with tech investments could lead to increased involvement.

“This [CFO dissatisfaction] is a clear signal for CIOs to expect a heightened level of collaboration with their business counterparts, as well as to prepare for increased oversight to ensure that their tech choices are driving business value,” the report said.

Study how CFOs assess technology decisions

CIOs can benefit from better understanding how CFOs assess the merit of new technology investments. As expected, Rimini Street found CFOs are more focused on the financial impact of investments. The top five factors considered by CFOs in tech investments are:

- The strategic value to the business.

- The sustainability of the technology solution.

- Expected return on investment.

- Ease of maintenance and support.

- CAPEX and OPEX considerations.

What CFOs want CIOs to focus on

CFOs may have different ideas about what CIOs should focus on. For example, the research found CFOs want CIO priorities to include risk management and compliance, customer success and engagement, major ERP reimplementation and migration, and revenue-generating technology.

CIOs may have a different opinion from their CFO when discussing technology-related decisions — especially given the importance of risk management and compliance for CFOs. But Rimini Street said CIOs can be confident that, on the whole, CFOs are driven more by results and return on investment than they are by the technology itself.

Go easy on ‘shiny toys’ and emerging technologies

CIOs are largely interested in emerging technologies: 64% of CIOs surveyed are already investing in artificial intelligence, while an additional 28% plan to invest this year. However, they do understand the need to be cautious, with 34% saying they are only supplementing existing enterprise technology rather than investing in new innovations.

SEE: 3 best practices for CIOs using emerging technology for business results

This caution could further support the CFO-CIO relationship. Rimini Street found that CFOs were not necessarily opposed to the introduction of emerging technologies, but they indicated they want to ensure they get the maximum value from new technology.

CFOs willing to support CIOs with future IT budgets

CIOs stand to benefit from the growing collaboration with CFOs. The report found that, if a CIO was to approach a CFO with a reasonable IT investment proposal that could demonstrate ROI, 23% of CFOs would be willing to approach the board to secure the required funding.

This bodes well for CIOs into the future. With a need to remain agile and invest in new technologies like AI to keep businesses competitive, support from CFOs and a strong relationship foundation could be the fulcrum for future business success.

The Latest News

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules

-

December 23, 2024‘Back myself and be fearless’: Konstas lives by mantra in first hit | cricket.com.au