Charter Hall seals record $3.3b in green loans for fund

- by Admin

- December 9, 2024

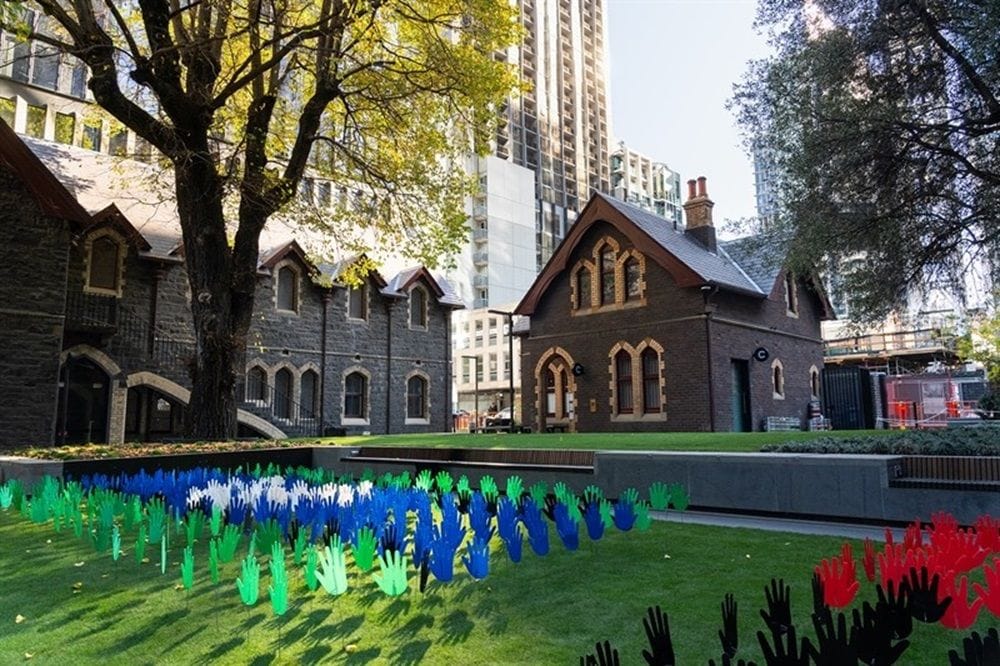

Property investor Charter Hall Group (ASX: CHC) has completed one of the largest green loan transactions in the Australian property sector after securing a $3.35 billion for one of its office investment vehicles.

The transaction, which was led by Commonwealth Bank (ASX: CBA), Westpac (ASX: WBC), ANX Group (ASX: ANZ), HSBC and SMBC Group, is part of a strategic capital management initiative for Charter Hall’s $8.6 billion flagship office fund, the Charter Hall Prime Office Fund (CPOF).

Through this initiative, the fund will leverage its sustainability credentials to implement a “best-in-class finance platform” providing financial and operating flexibility to deliver on its “premium-grade development pipeline and strategic objective of providing long-term outperformance for its investors”.

The loan facilities have significantly boosted Charter Hall sustainable finance to more than $9 billion, all of which is targeting the office sector.

“This transaction underpins the strength of CPOF’s sustainability credentials and the competitive advantage that our investment in sustainability provides our fund investors,” says Miriam Patterson, fund manager at Charter Hall Prime Office Fund.

“This has been driven in large part by Charter Hall’s approach to using independent green building rating tools to benchmark performance and drive continuous improvement.

“As a result, we’ve been able to efficiently implement this initiative, securing financial covenants that provide market-leading headroom.

“It also allows us operational flexibility to continue our strategic portfolio curation, reducing the average age of the portfolio and capitalising on the bifurcation of tenant demand toward new state-of-the-art office accommodation.”

Patterson says that this includes the development of new premium grade towers, such as Melbourne’s 60 King William, Wesley Place and 555 Collins Street developments, which have been completed, and Chifley South in the Sydney CBD and 360 Queen Street in Brisbane which are currently under construction.

“Our portfolio curation also enables us to maintain sector-leading portfolio WALE (weighted average lease expiry), with our track record of new developments being fully leased prior to or upon completion and achieving longer WALEs (weighted average lease expiries) than other stabilised assets,” she says.

The new green loan facilities, which were fully underwritten but closed oversubscribed, have been certified by the Climate Bond Initiative and independently verified by DNV and KPMG.

The Latest News

-

December 22, 2024Zheng to skip United Cup, focus on Aussie Open

-

December 22, 20242024 runner-up Qinwen Zheng pulls out of Australian Open lead-in event

-

December 22, 2024‘I want to be out there’: Webster’s long wait for Test debut could be over with Marsh’s all-round capability clouded

-

December 22, 2024China’s Zheng to skip United Cup, needs ‘extra rest’ ahead of Australian Open

-

December 22, 2024India boycott press match after media battles