Exploring 3 High Growth Tech Stocks In Australia

- by Admin

- August 26, 2024

In the last week, the Australian market has stayed flat, but it has risen 12% in the past 12 months with earnings forecast to grow by 14% annually. In this favorable environment, identifying high growth tech stocks can be crucial for investors looking to capitalize on robust performance and future potential.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.43% | 29.47% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.90% | 28.13% | ★★★★★★ |

| Doctor Care Anywhere Group | 23.44% | 96.41% | ★★★★★★ |

| Enlitic | 104.77% | 94.35% | ★★★★★☆ |

| DUG Technology | 13.29% | 46.01% | ★★★★★☆ |

| Megaport | 13.56% | 32.16% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Mesoblast | 45.23% | 49.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| SiteMinder | 20.26% | 70.41% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our ASX High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EVT Limited operates as an entertainment, hospitality, and leisure company in Australia, New Zealand, and Germany with a market cap of A$1.79 billion.

Operations: The company generates revenue primarily from its Hotels and Resorts segment (A$377.63 million), Entertainment in Australia and New Zealand (A$474.26 million), Entertainment in Germany (A$272.54 million), Thredbo Alpine Resort (A$88.36 million), and Property operations (A$10.62 million).

EVT Limited reported a revenue of AUD 1.23 billion for the full year ending June 30, 2024, showing a slight decrease from AUD 1.28 billion the previous year. Despite this, earnings are forecast to grow at an impressive rate of 30.2% annually over the next few years, significantly outpacing the Australian market’s average growth rate of 13.6%. The company’s net profit margin has dropped to 3% from last year’s 10.7%, reflecting challenges in maintaining profitability amid fluctuating market conditions. EVT’s focus on innovation is evident with substantial R&D expenses contributing to long-term strategic initiatives aimed at enhancing their entertainment and technology segments.

Simply Wall St Growth Rating: ★★★★★★

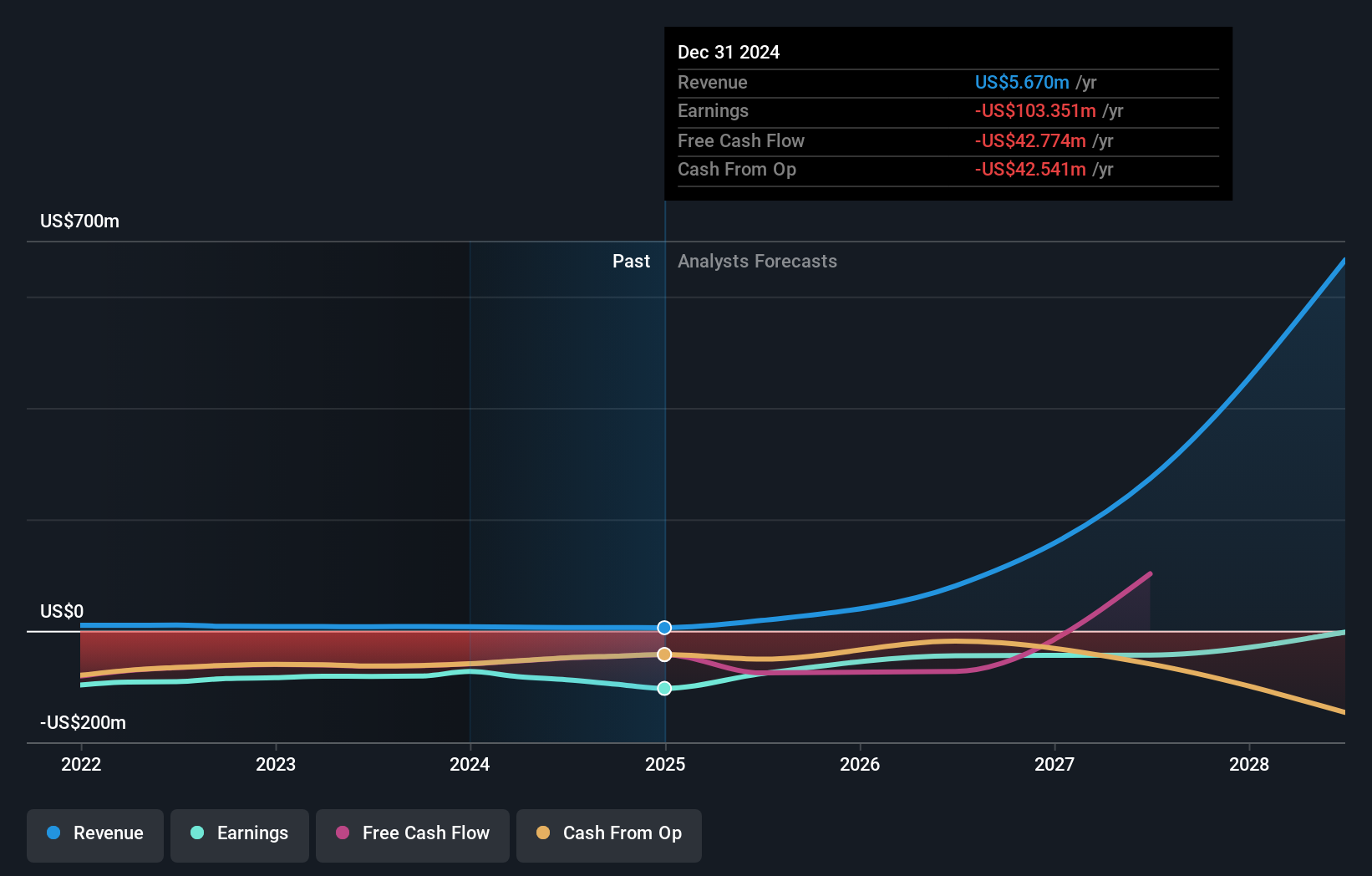

Overview: Mesoblast Limited develops regenerative medicine products in Australia, the United States, Singapore, and Switzerland with a market cap of A$1.10 billion.

Operations: Mesoblast Limited focuses on developing regenerative medicine products, generating revenue primarily from its Adult Stem Cell Technology Platform, which brought in $7.47 million. The company operates across Australia, the United States, Singapore, and Switzerland.

Mesoblast’s innovative approach in cell therapy, particularly with Ryoncil for pediatric SR-aGVHD, positions it uniquely in the biotech sector. The company’s revenue is forecast to grow at an impressive 45.2% annually, significantly outpacing the Australian market’s average growth rate of 5.3%. With R&D expenses representing a substantial portion of their budget—critical for long-term innovation—Mesoblast anticipates a decision on its FDA resubmission by January 7, 2025. This strategic focus underscores its potential to address unmet medical needs and drive future profitability.

Simply Wall St Growth Rating: ★★★★☆☆

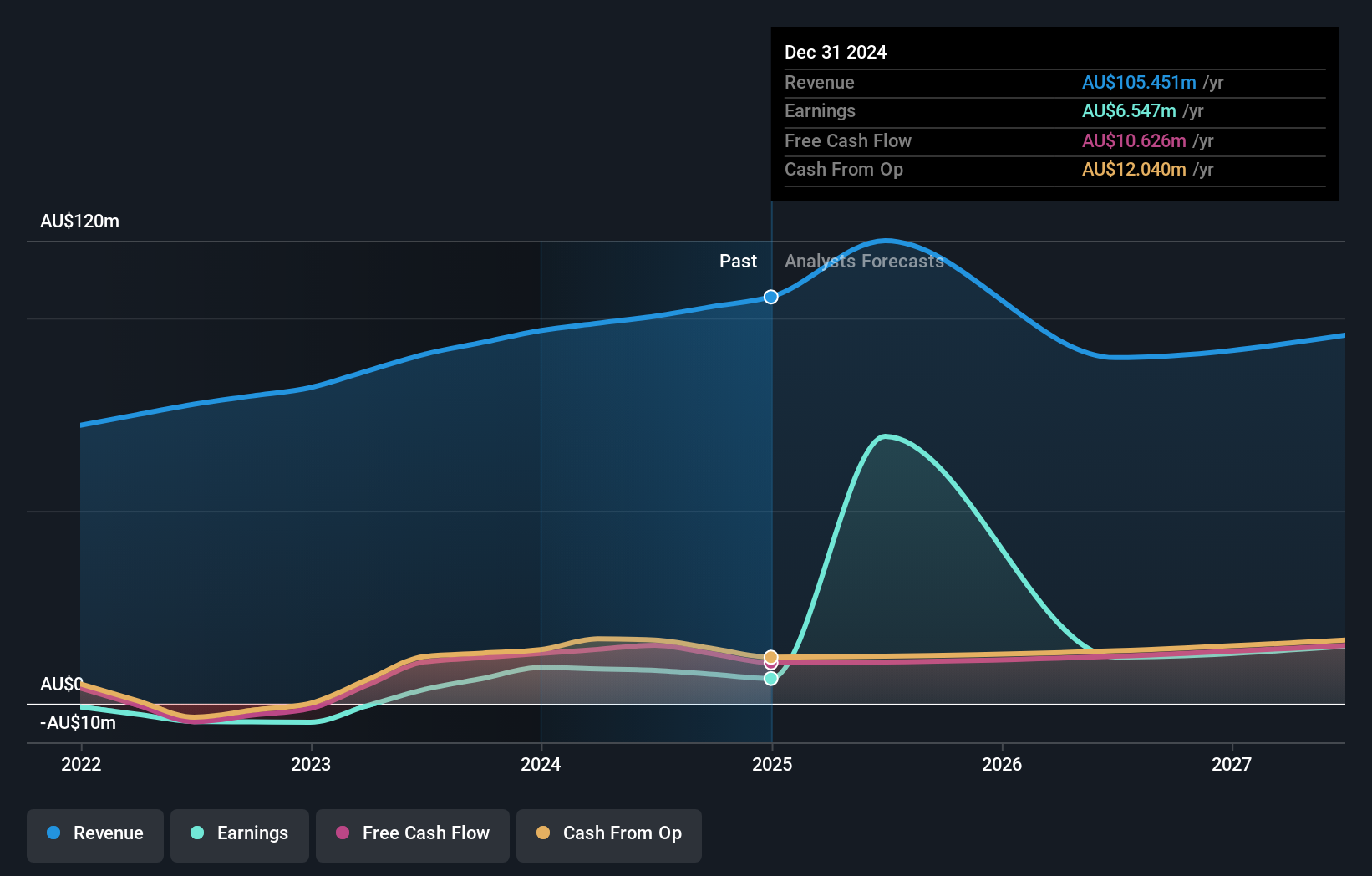

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$523.20 million.

Operations: RPMGlobal Holdings Limited generates revenue primarily through its Software segment (A$71.72 million) and Advisory services (A$28.56 million). The company operates across multiple regions including Australia, Asia, the Americas, Africa, and Europe.

RPMGlobal Holdings has shown impressive growth, with revenue increasing to AUD 104.19 million from AUD 91.56 million last year and net income rising to AUD 8.66 million from AUD 3.69 million. The company’s R&D expenses, which are crucial for innovation in the tech sector, have been a significant focus, contributing to their forecasted revenue growth of 10.2% per year and earnings growth of 24% annually over the next three years. Their recent equity buyback plan expansion by an additional 11.18 million shares underscores confidence in their financial health and future prospects within the software industry transitioning towards SaaS models for recurring revenue streams.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if EVT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules