Exploring High Growth Tech Stocks In Australia September 2024

- by Admin

- September 22, 2024

The Australian market has been buoyed by positive sentiment from Wall Street and optimism surrounding a potential US Fed Rate cut, with the ASX200 closing just below an all-time high. Amidst this backdrop, sectors such as Discretionary and Utilities have shown gains while Real Estate lagged, highlighting a mixed performance across different industries.

In this environment, identifying high growth tech stocks that can capitalize on favorable economic conditions and investor sentiment becomes crucial. This article will explore three promising tech stocks in Australia that are well-positioned for significant growth in September 2024.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| DUG Technology | 10.90% | 31.83% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★★☆

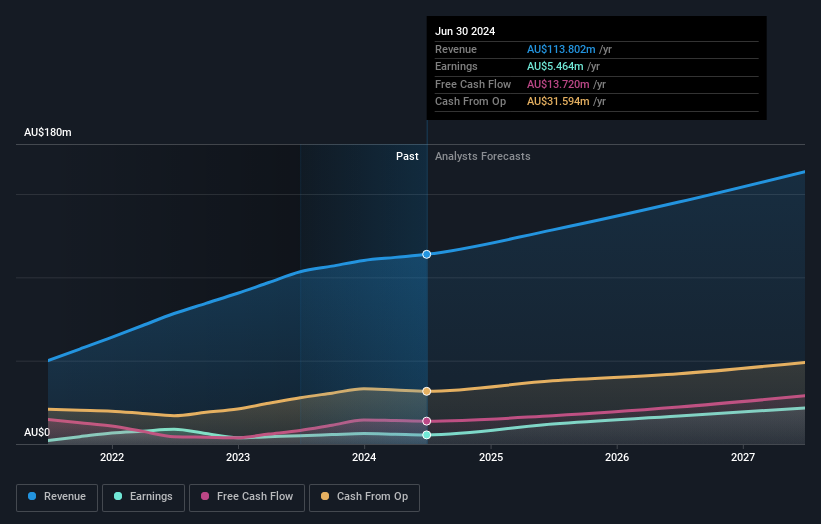

Overview: Infomedia Ltd, a technology company with a market cap of A$610.86 million, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Operations: Infomedia generates revenue primarily from publishing periodicals, amounting to A$140.83 million. The company’s offerings include electronic parts catalogues, service quoting software, and e-commerce solutions tailored for the automotive industry.

Infomedia has demonstrated robust financial performance with a notable 32.4% increase in earnings over the past year, underpinned by a strategic expansion of its product suite and international presence. This growth trajectory is set to continue, with earnings expected to rise by 22% annually. Particularly impressive is Infomedia’s commitment to innovation, as reflected in its R&D expenses which are pivotal in driving these advancements. With R&D investments aligning closely with revenue growth—marked at 7.6% per year—the firm is well-positioned to maintain its competitive edge in the tech sector. This approach not only enhances their product offerings but also solidifies their standing amidst Australia’s high-growth tech landscape, promising an intriguing future for the company and its stakeholders.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions across various sectors in Australia and has a market cap of A$370.29 million.

Operations: ReadyTech Holdings Limited generates revenue through three primary segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million). The company operates within Australia, focusing on technology-based solutions across these sectors.

ReadyTech Holdings, a player in Australia’s tech scene, has shown promising growth with its recent financial performance indicating a 10.9% increase in revenue year-over-year. This growth is complemented by an impressive forecast of earnings expected to surge by 24.1% annually over the next three years. The company’s dedication to innovation is evident from its R&D expenses which have been strategically aligned to bolster future capabilities and market competitiveness. With these investments, ReadyTech not only secures its position in the evolving software industry but also sets a robust foundation for sustained growth and expansion in high-demand sectors.

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.44 billion.

Operations: SiteMinder Limited generates revenue primarily through its software and programming segment, which contributed A$190.84 million. The company focuses on providing online guest acquisition platforms and commerce solutions for accommodation providers globally.

SiteMinder, amidst Australia’s competitive tech landscape, demonstrates notable resilience and potential for robust growth. With a striking 19.4% forecasted annual revenue increase, the company outpaces the broader Australian market’s 5.4% growth expectation. Even more compelling is the projected earnings surge of 60.3% per year, positioning SiteMinder well above many peers in terms of profitability outlook. This financial vigor is underpinned by a significant commitment to innovation, as evidenced by R&D expenditures that strategically drive its product offerings and market expansion efforts—critical as the firm moves towards profitability in an increasingly digital world.

Recent fiscal revelations further underscore SiteMinder’s upward trajectory; sales soared to AUD 190.67 million from AUD 151.38 million last year alongside a halving of net losses to AUD 25.13 million from AUD 49.3 million previously reported—a testament to improving operational efficiency and market adaptation strategies that could set a precedent for future performance in this high-stakes arena.

Turning Ideas Into Actions

- Embark on your investment journey to our 63 ASX High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024Here’s why Golf Twitter lost its damn mind over Team Langer’s PNC victory – Australian Golf Digest

-

December 23, 2024From smaller homes to screen time, backyard cricket is facing challenges in modern Australia

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World