Exploring High Growth Tech Stocks in Australia with Promising Potential

- by Admin

- September 3, 2024

Over the last 7 days, the Australian market has remained flat, but it is up 10% over the past year with earnings expected to grow by 12% per annum over the next few years. In this context, identifying high growth tech stocks with strong potential can be crucial for investors looking to capitalize on future opportunities in a steadily advancing market.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.63% | 22.01% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| DUG Technology | 10.90% | 32.21% | ★★★★★☆ |

| Wrkr | 36.14% | 124.86% | ★★★★★★ |

| Careteq | 24.12% | 104.18% | ★★★★★☆ |

| Adveritas | 50.14% | 144.21% | ★★★★★★ |

| SiteMinder | 19.39% | 64.28% | ★★★★★☆ |

| Senetas | 14.33% | 118.52% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our ASX High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies healthcare imaging software and radiology information system software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe with a market cap of A$15.90 billion.

Operations: Pro Medicus Limited generates revenue primarily through the production and sale of integrated healthcare imaging software and radiology information system (RIS) software, amounting to A$161.50 million. The company operates across Australia, North America, and Europe.

Pro Medicus has demonstrated robust growth, with revenue increasing from AUD 127.33 million to AUD 166.33 million and net income rising from AUD 60.65 million to AUD 82.79 million in the past year. The company’s R&D expenses have been a significant driver, contributing to its innovative edge in healthcare imaging software; this focus on R&D is reflected in their spending of approximately $16M annually, fueling future advancements and maintaining competitive advantage. Additionally, the company announced a fully franked final ordinary dividend of 22 cents per share, marking a substantial increase of 33.3%, indicating strong financial health and confidence in sustained profitability.

In terms of industry impact, Pro Medicus’s advanced imaging solutions are increasingly adopted by high-profile clients such as major hospitals and diagnostic centers globally, ensuring recurring revenue streams through long-term contracts. The forecasted annual profit growth rate stands at an impressive 18.6%, significantly outpacing the broader Australian market’s expected growth rate of 12.1%. This positions Pro Medicus as a formidable player within Australia’s tech landscape while underscoring its potential for continued expansion driven by strategic investments in technology and client acquisition strategies.

Simply Wall St Growth Rating: ★★★★★☆

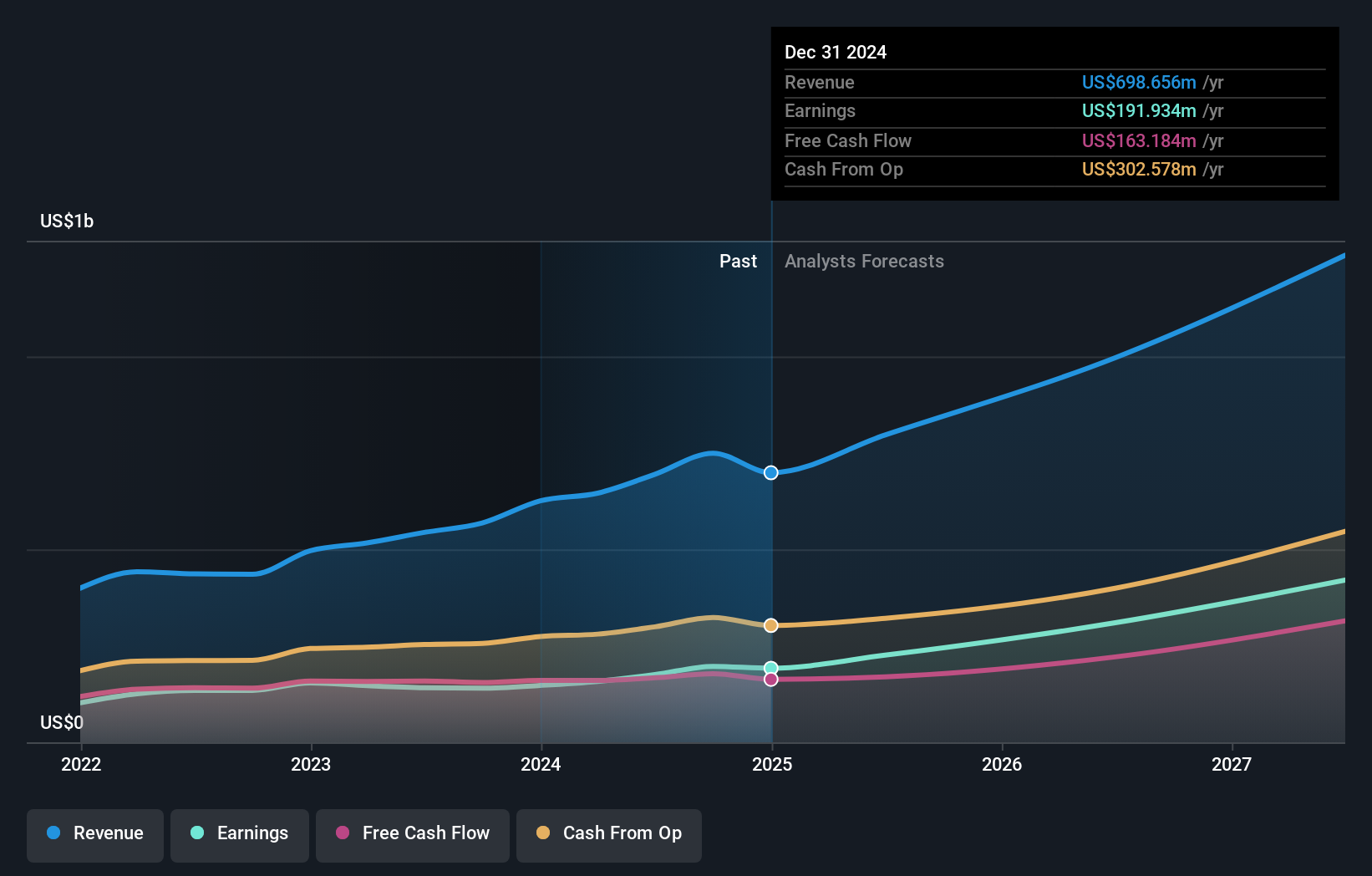

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various global regions, with a market cap of A$41.25 billion.

Operations: WiseTech Global Limited generates revenue primarily from its Internet Software & Services segment, amounting to A$1.04 billion. The company’s software solutions cater to logistics execution across multiple regions, including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

WiseTech Global has shown impressive growth, with revenue increasing to AUD 1.04 billion from AUD 816.8 million and net income rising to AUD 262.8 million from AUD 212.2 million over the past year. The company’s R&D expenses, which are a substantial driver of innovation, amounted to approximately $161M annually, representing a significant investment in future advancements and maintaining competitive advantage within the logistics software industry. Additionally, WiseTech announced a fully franked final ordinary dividend of 9.2 cents per share, reflecting a confident outlook on sustained profitability and robust financial health.

The company’s earnings growth rate of 23.9% per year significantly outpaces the broader Australian market’s expected growth rate of 12.1%, underscoring its strong position within Australia’s tech landscape and potential for continued expansion driven by strategic investments in technology and client acquisition strategies such as high-profile clients like DHL and FedEx benefiting from their comprehensive SaaS solutions for global logistics management systems.

Simply Wall St Growth Rating: ★★★★★☆

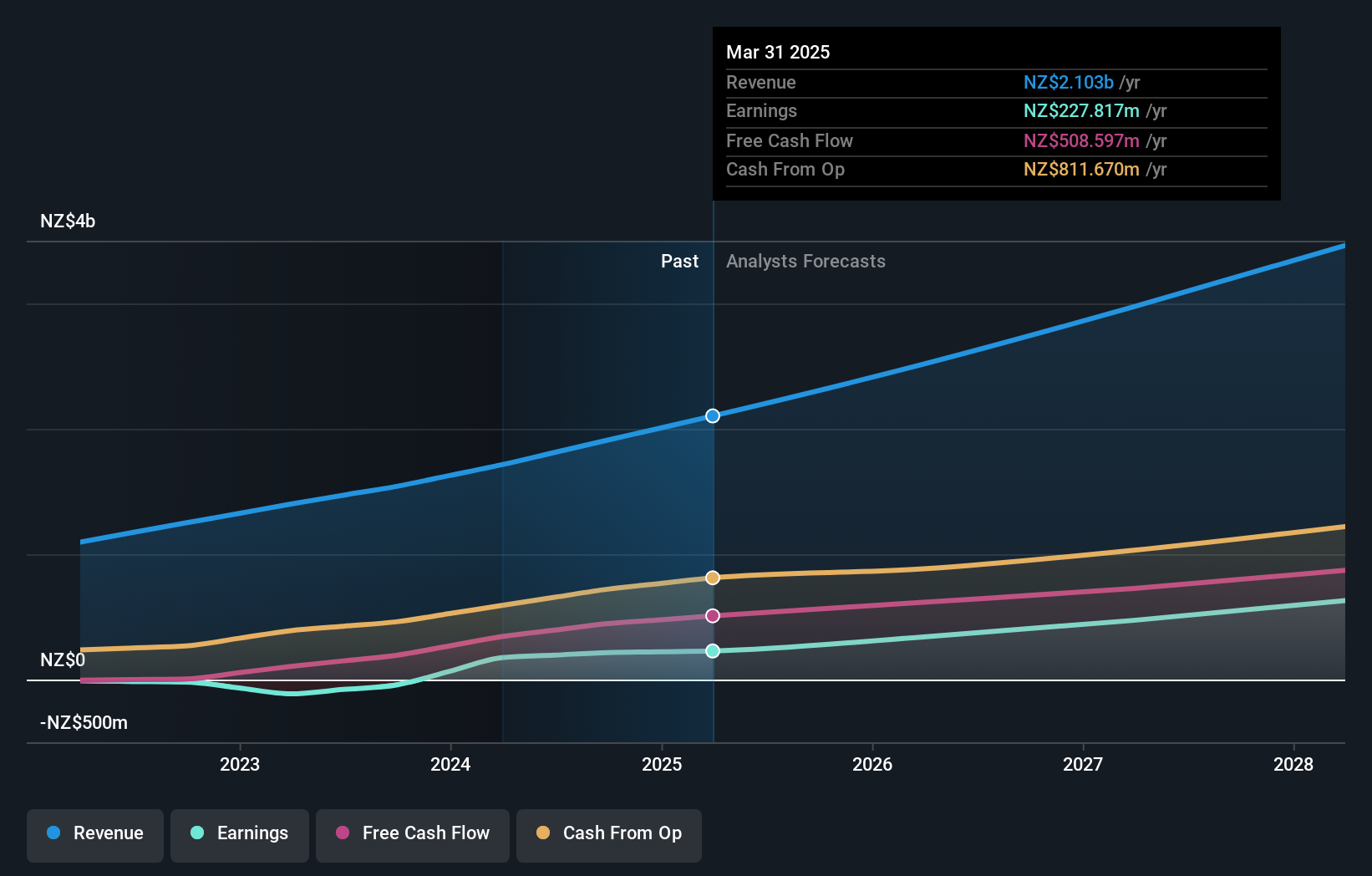

Overview: Xero Limited, along with its subsidiaries, offers online business solutions for small businesses and their advisors across Australia, New Zealand, and internationally, with a market cap of A$22.09 billion.

Operations: Xero Limited generates revenue primarily through providing online solutions for small businesses and their advisors, amounting to NZ$1.71 billion. The company’s operations span Australia, New Zealand, and international markets.

Xero’s revenue is forecast to grow at 13.5% per year, significantly outpacing the broader Australian market’s 5.2%. Its earnings are expected to rise by 24.2% annually, underscoring robust growth prospects. Recent product launches like Xero Inventory Plus enhance inventory management for small businesses and integrate with Amazon’s FBA program, showcasing innovation in SaaS solutions. Additionally, R&D expenses of $161M reflect a commitment to advancing its software capabilities and maintaining competitive edge in the industry.

Make It Happen

- Navigate through the entire inventory of 58 ASX High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules