Exploring Three High Growth Tech Stocks in Australia

- by Admin

- August 22, 2024

The market is up 2.1% over the last week and 11% over the last 12 months, with earnings expected to grow by 13% per annum. In this favorable environment, identifying high growth tech stocks in Australia involves looking for companies that demonstrate strong innovation, robust financial health, and significant market potential.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Telix Pharmaceuticals | 20.78% | 41.33% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.90% | 27.04% | ★★★★★★ |

| Infomedia | 7.86% | 27.83% | ★★★★★☆ |

| Doctor Care Anywhere Group | 23.44% | 96.41% | ★★★★★★ |

| Enlitic | 104.77% | 94.35% | ★★★★★☆ |

| DUG Technology | 11.51% | 46.75% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Mesoblast | 45.23% | 49.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| SiteMinder | 20.26% | 70.41% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our ASX High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited develops technology solutions for various sectors including United Nations organizations, mining companies, security and military groups, government departments, individuals, and small-scale miners with a market cap of A$2.61 billion.

Operations: Codan Limited generates revenue primarily through the sale of technology solutions to diverse sectors such as mining, security, military, and government organizations. The company has a market cap of A$2.61 billion.

Codan’s revenue is projected to grow at 7.8% annually, outpacing the Australian market’s 5.4%. This growth is underpinned by a robust earnings forecast of 15.1% per year, significantly higher than the industry average of 13.3%. The company reported sales of AUD $550.5 million for FY2024, up from AUD $456.5 million last year, with net income rising to AUD $81.3 million from AUD $67.7 million previously. Their focus on R&D has seen expenses reach approximately 6% of total revenue, highlighting their commitment to innovation in tech and software solutions.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd (ASX:IFM) is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$678.66 million.

Operations: Infomedia Ltd generates revenue primarily through its publishing of periodicals, amounting to A$136.58 million. The company focuses on providing electronic parts catalogues and service quoting software for the automotive industry.

Infomedia’s earnings are forecast to grow 27.8% annually, significantly outpacing the Australian market’s 13.3%. Revenue is expected to rise by 7.9% per year, driven by a diversified product suite and expanding international footprint. R&D expenses have been substantial, accounting for approximately AUD $15 million or about 6% of total revenue in FY2024, underscoring their commitment to innovation. Recent board changes aim to ensure stable leadership as the company navigates its high-growth trajectory in tech and software solutions.

Simply Wall St Growth Rating: ★★★★★☆

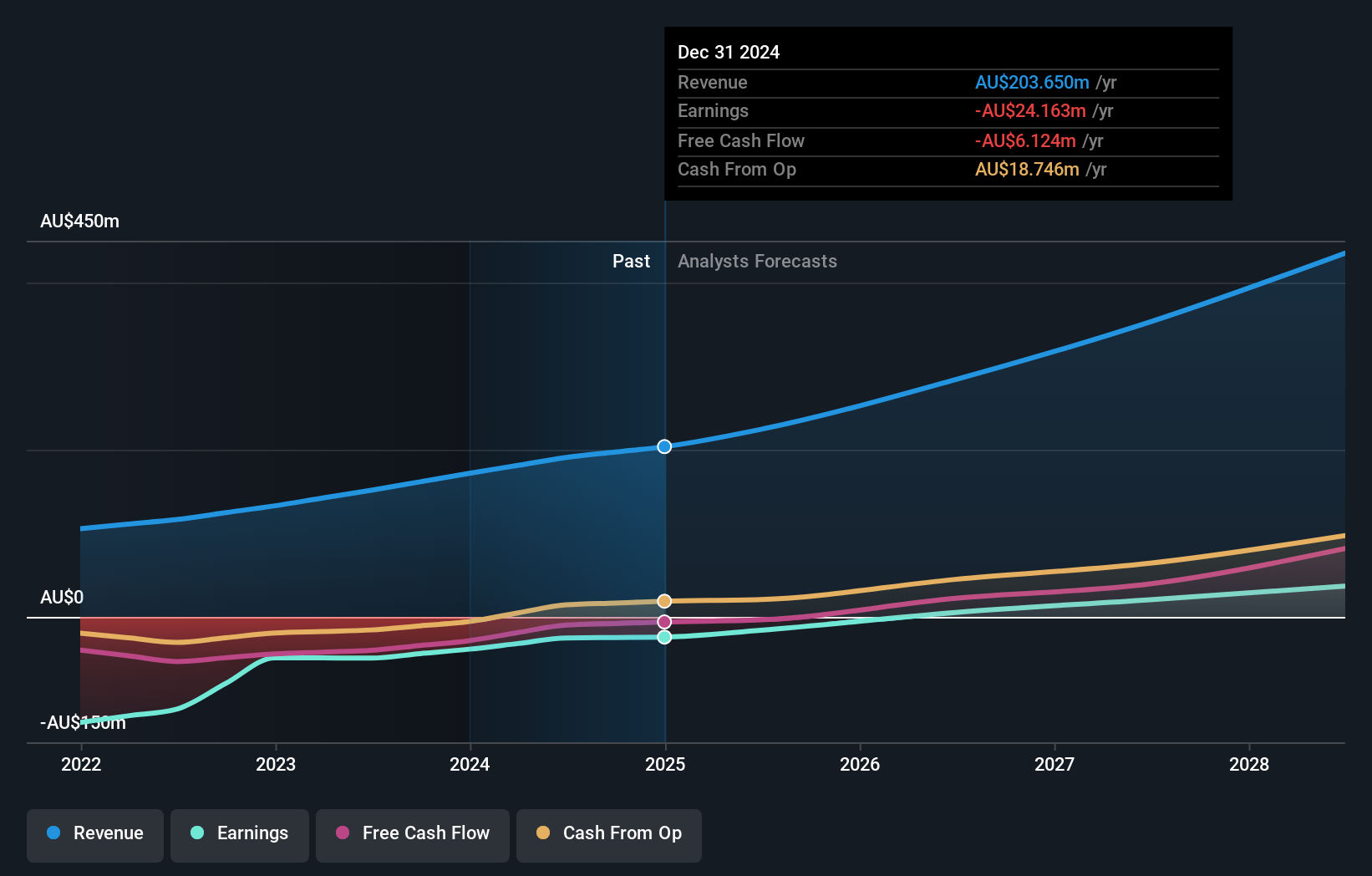

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.44 billion.

Operations: SiteMinder Limited generates revenue primarily from its Software & Programming segment, which reported A$171.70 million. The company focuses on providing online guest acquisition platforms and commerce solutions for accommodation providers globally.

SiteMinder’s revenue is forecast to grow at 20.3% annually, significantly outpacing the Australian market’s 5.4%. Despite being unprofitable currently, earnings are expected to surge by 70.41% per year over the next three years. The company’s strategic partnership with Cloudbeds aims to enhance connectivity and revenue capabilities for over 60,000 hoteliers globally, offering expanded distribution and actionable insights. R&D expenses have been notable; AUD $12 million was allocated in FY2024, reflecting a strong commitment to innovation and future growth potential in the SaaS model for hotel management solutions.

Turning Ideas Into Actions

- Embark on your investment journey to our 53 ASX High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules

-

December 23, 2024‘Back myself and be fearless’: Konstas lives by mantra in first hit | cricket.com.au