Exploring Three High Growth Tech Stocks In Australia

- by Admin

- September 1, 2024

The ASX200 closed up 0.58% at 8,091.9 points, with the last day of the earnings season bringing mixed results across various sectors, while retail sales data from July showed a plateau in activity. As analysts digest these developments and consider their implications for interest rates, it is crucial to identify high-growth tech stocks that exhibit strong fundamentals and resilience in a fluctuating market environment like Australia’s.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.59% | 21.65% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| AVA Risk Group | 32.46% | 118.83% | ★★★★★★ |

| DUG Technology | 10.90% | 32.21% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Wrkr | 32.87% | 124.86% | ★★★★★★ |

| Careteq | 24.12% | 104.18% | ★★★★★☆ |

| Adveritas | 50.14% | 144.21% | ★★★★★★ |

| SiteMinder | 19.40% | 60.46% | ★★★★★☆ |

| Senetas | 14.33% | 118.52% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Opthea Limited is a clinical stage biopharmaceutical company focused on developing and commercializing therapies for eye diseases in Australia, with a market cap of A$720.19 million.

Operations: Opthea Limited is focused on developing and commercializing therapies for eye diseases in Australia. As a clinical stage biopharmaceutical company, it currently does not generate revenue.

Opthea’s revenue is projected to grow at an impressive 53.7% annually, significantly outpacing the Australian market’s 5.3% growth rate. Despite a net loss of $220.24 million for the year ending June 30, 2024, the company is expected to achieve profitability within three years, with earnings forecasted to increase by 57.86% per year. The recent formation of a Medical Advisory Board aims to enhance its clinical programs and address unmet medical needs in retinal diseases, positioning Opthea for future advancements in ophthalmology.

Simply Wall St Growth Rating: ★★★★☆☆

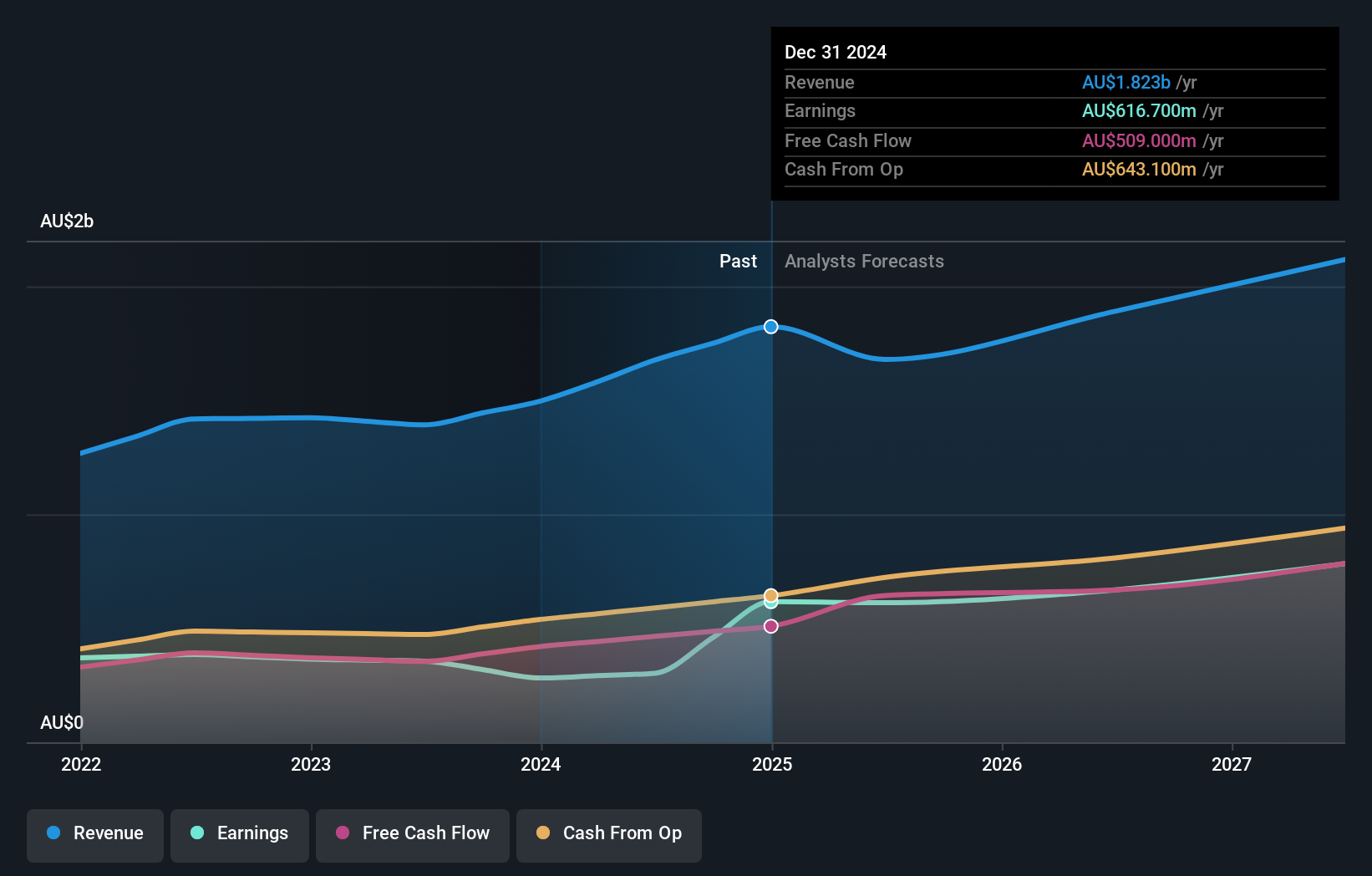

Overview: REA Group Limited, along with its subsidiaries, operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market cap of A$28.91 billion.

Operations: REA Group generates revenue primarily from online property advertising, with significant contributions from its Australian Property & Online Advertising segment (A$1.25 billion) and Financial Services segment (A$320.60 million), as well as its operations in India (A$103.10 million). The company focuses on digital real estate services across various international markets, leveraging its extensive online platforms to connect buyers, sellers, and renters.

REA Group’s earnings are forecast to grow at 17.7% annually, surpassing the Australian market’s 12.3% growth rate. Despite experiencing a one-off loss of A$153.6 million in the last fiscal year, REA remains focused on innovation and customer-centric solutions within the Interactive Media and Services industry. The company reported net income of A$302.8 million for FY2024, with revenue expected to increase by 6.2% per year, outpacing the broader market’s 5.3%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited, along with its subsidiaries, operates online employment marketplace services across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and internationally with a market cap of A$8.21 billion.

Operations: SEEK Limited generates revenue primarily from its Employment Marketplaces in ANZ (A$840.10 million) and Asia (A$244 million). The company focuses on providing online employment marketplace services across various regions.

SEEK’s forecasted revenue growth of 7.4% annually surpasses the broader Australian market’s 5.3%, indicating robust future potential. Despite a net loss of A$100.9 million for FY2024, the company is expected to see earnings grow by an impressive 41.36% per year over the next three years, signaling a strong rebound in profitability prospects. Notably, SEEK has invested heavily in R&D with expenses amounting to A$50 million this year, underscoring its commitment to innovation and technological advancement within the recruitment sector.

Next Steps

- Navigate through the entire inventory of 57 ASX High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules