Good news for RBA and inflation

- by Admin

- November 12, 2024

The Reserve Bank of Australia (RBA) ‘s interest rate decision last week was undeniably “hawkish”.

The RBA explicitly stated that “underlying inflation is too high” at 3.5% and admitted that it underappreciated the strength of public spending, which has inflated aggregate demand and kept unemployment low.

The NAB business survey was released on Tuesday and contained positive information regarding underlying inflation.

As illustrated in the following charts from Justin Fabo at Antipodean Macro, Australian businesses noted that labour cost growth slowed further in October.

Advertisement

This, according to Fabo, is a good indicator of trends in Australia’s domestic market services inflation and is pointing to further disinflation.

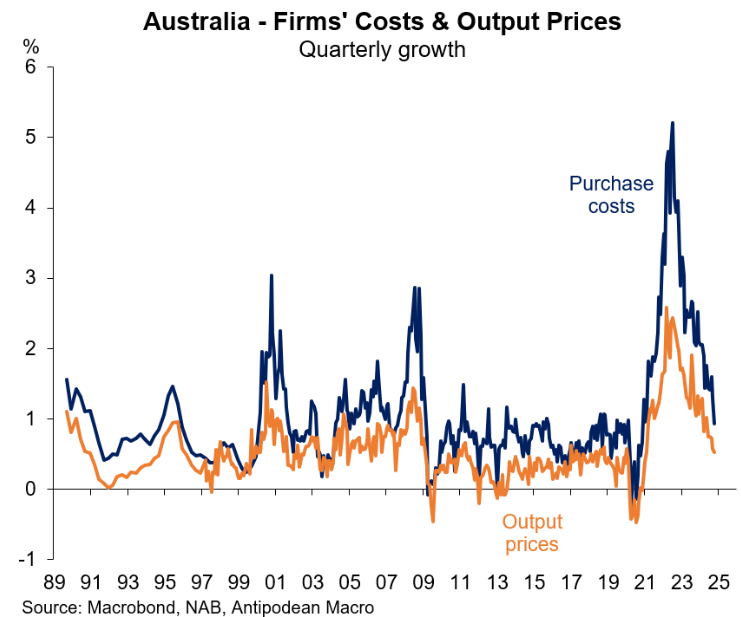

Fabo also noted that Australian businesses reported slower growth in output prices and purchase costs in October. In fact, the growth in purchase costs declined to the 2000-2019 average.

Advertisement

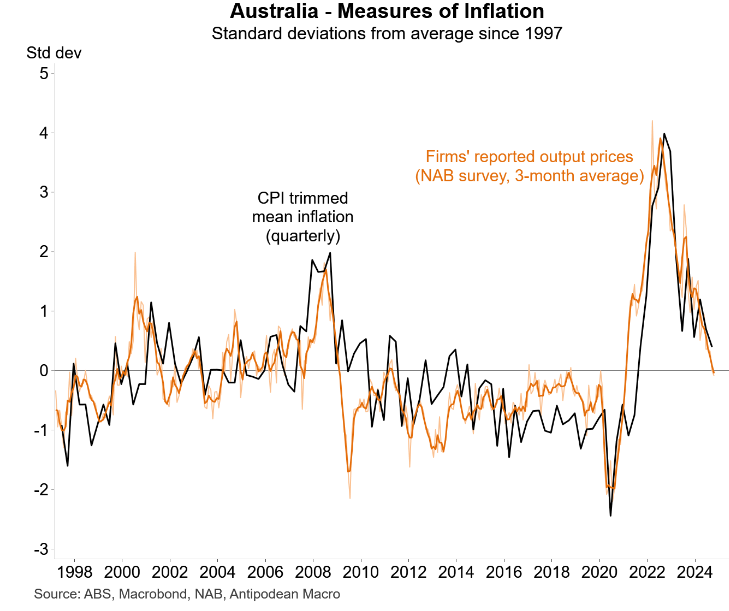

To top it off, Fabo plotted the above data on firm’s reported output prices against Australia’s trimmed mean inflation:

Advertisement

As you can see, the disinflation reported by the NAB business survey points to further disinflation in underlying inflation.

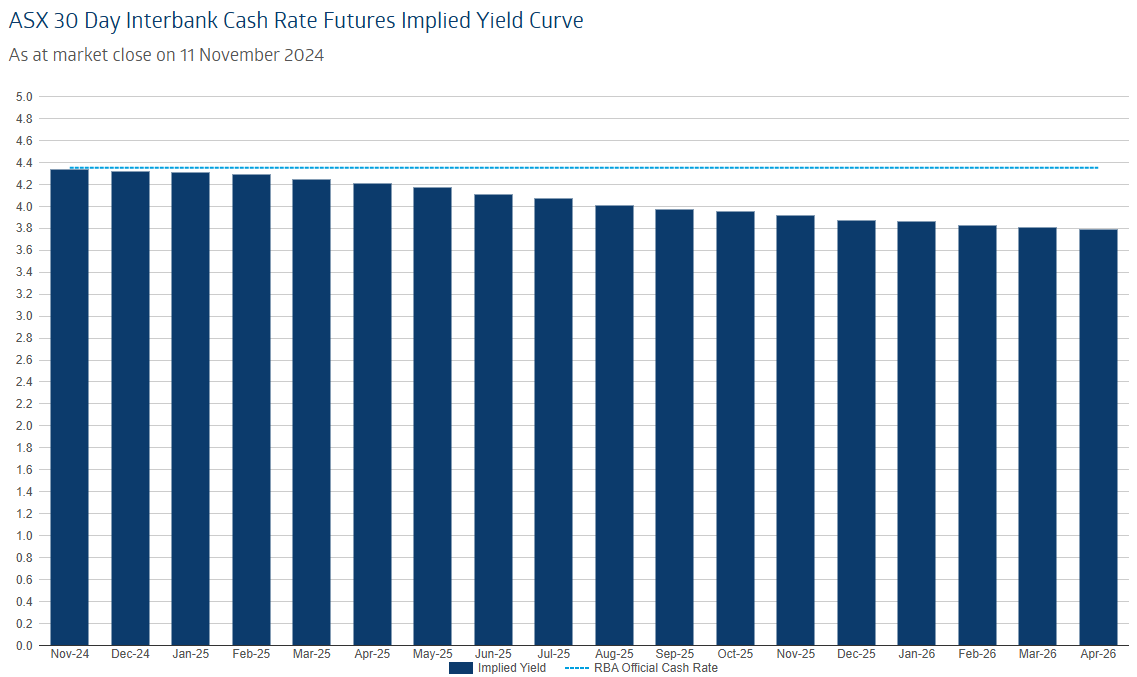

Futures markets are tipping that Australia’s first interest rate cut will mid-next year.

Advertisement

The Albanese government will be desperately hoping that the NAB business survey is indicative of broader inflationary pressures, prompting the RBA to cut rates well ahead of the May 2025 election.

The Latest News

-

December 22, 2024Billionaire-backed sports streamer buys Foxtel

-

December 22, 2024Footy world rallies around Lions premiership winner and family amid awful news

-

December 22, 2024JPMorgan exits Australia’s Star Entertainment

-

December 22, 2024Fearless teen debutant touches down for Boxing Day

-

December 22, 2024Live: Both Australian openers dropped as NZ miss big chances