High Growth Australian Tech Stocks To Watch In August 2024

- by Admin

- August 28, 2024

The Australian market has shown a positive trend, rising 1.1% over the last week and 11% over the past year, with earnings projected to grow by 13% annually in the coming years. In this favorable environment, identifying high-growth tech stocks that can capitalize on these conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.67% | 28.71% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.90% | 28.13% | ★★★★★★ |

| Doctor Care Anywhere Group | 23.44% | 96.41% | ★★★★★★ |

| Megaport | 13.60% | 32.52% | ★★★★★☆ |

| Enlitic | 104.77% | 94.35% | ★★★★★☆ |

| DUG Technology | 13.29% | 46.01% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Mesoblast | 45.23% | 49.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| SiteMinder | 19.40% | 61.16% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qoria Limited, with a market cap of A$433.74 million, focuses on marketing, distributing, and selling cyber safety products and services.

Operations: Qoria Limited generates its revenue by marketing, distributing, and selling cyber safety products and services. The company operates within a niche market focused on digital security solutions.

Qoria’s recent earnings report highlighted a significant improvement, with sales reaching AUD 99.45 million, up from AUD 81.88 million last year, while net losses narrowed to AUD 54.77 million from AUD 86.72 million. Despite being unprofitable, the company is on track to achieve profitability within three years and boasts an expected annual earnings growth rate of 78.31%. The revenue growth forecast of 15.2% per year outpaces the Australian market’s average of 5.3%, driven by robust R&D investments totaling $12M annually.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited, along with its subsidiaries, provides online employment marketplace services across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international regions and has a market cap of A$8.28 billion.

Operations: SEEK Limited generates revenue primarily from its Employment Marketplaces segments in Australia and New Zealand (A$840.10 million) and Asia (A$244 million). The company focuses on providing online employment marketplace services across various international regions.

SEEK’s revenue for the year ended June 30, 2024, was AUD 1.08 billion, showing a decrease from AUD 1.16 billion the previous year. Despite reporting a net loss of AUD 100.9 million compared to a net income of AUD 1.05 billion last year, SEEK is expected to grow its earnings by an impressive 41.36% annually over the next three years. The company’s R&D expenses are substantial at $12M annually, indicating strong investment in innovation and future growth potential within Australia’s tech sector.

Simply Wall St Growth Rating: ★★★★★☆

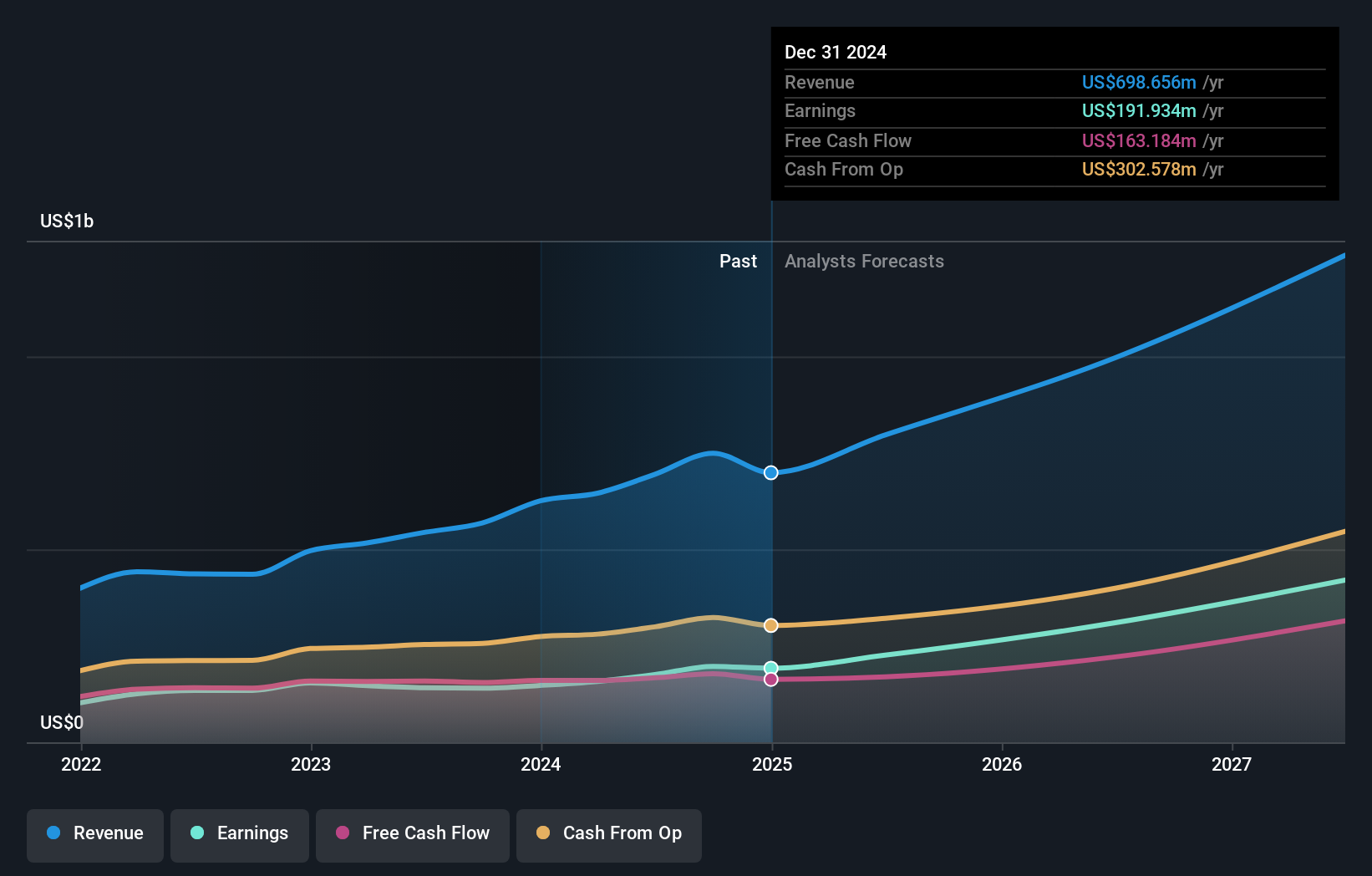

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions, with a market cap of A$39.06 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, which accounts for A$1.04 billion. WiseTech Global operates across the Americas, Asia Pacific, Europe, the Middle East, and Africa.

WiseTech Global’s revenue surged to AUD 1.04 billion in FY24, reflecting a robust growth of 27.5% from the previous year. Earnings also climbed significantly, with net income reaching AUD 262.8 million, up by 23.8%. The company’s R&D expenses amounted to AUD 161.4 million, underscoring its commitment to innovation and maintaining competitive advantage in the tech sector. With anticipated revenue growth between 25%-30% for FY25 and a recent dividend increase of 10%, WiseTech Global demonstrates strong future prospects within Australia’s high-growth tech landscape.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World

-

December 23, 2024Championship three-peat reward for ‘clinical’ Aussies | cricket.com.au

-

December 23, 2024Australian tennis star Purcell takes on voluntary provisional suspension for breaking anti-doping rules