High Growth Tech in Australia Featuring 3 Promising Stocks

- by Admin

- September 23, 2024

Over the last 7 days, the Australian market has risen 1.4%, contributing to a 15% increase over the past 12 months, with earnings expected to grow by 12% per annum over the next few years. In this promising environment, identifying high-growth tech stocks that can capitalize on these favorable conditions is crucial for potential investors.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| DUG Technology | 10.79% | 31.83% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our ASX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hansen Technologies Limited develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$899.51 million.

Operations: Hansen Technologies Limited generates revenue primarily from its billing systems software, with A$347.61 million attributed to this segment. The company focuses on serving the energy, utilities, communications, and media sectors.

Hansen Technologies, amidst a challenging landscape, showcases resilience with a projected revenue growth of 5.8% annually, outpacing the Australian market’s 5.4%. This growth is complemented by an impressive forecast in earnings expansion at 21.3% per year, significantly higher than the broader market’s 12.3%. Despite a dip in profit margins from 13.7% to 6%, recent strategic moves like securing the Norwegian DSO Area Nett AS for their Hansen CIS system underscore its commitment to enhancing service delivery through innovative SaaS solutions. These efforts are crucial as they navigate through recent fiscal pressures highlighted by a nearly halved net income of AUD 21.06 million and maintain competitive dividends with recent payouts totaling AUD 0.05 per share.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies healthcare imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$18.10 billion.

Operations: Pro Medicus Limited generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$161.50 million. The company’s offerings include advanced imaging software and radiology information system (RIS) services tailored for hospitals, imaging centers, and healthcare groups in multiple regions including Australia, North America, and Europe.

Pro Medicus, a standout in the Australian tech landscape, has demonstrated robust financial performance with a significant 36.5% growth in earnings over the past year. The company’s revenue is expected to increase by 16.8% annually, surpassing the broader Australian market’s growth rate of 5.4%. This upward trajectory is supported by an aggressive investment in R&D, which not only fuels innovation but also solidifies its competitive edge in healthcare technology solutions. Furthermore, Pro Medicus announced a substantial dividend increase to AUD 0.40 per share for FY2024, reflecting its strong cash flow and commitment to shareholder returns amidst expanding market presence.

Simply Wall St Growth Rating: ★★★★★☆

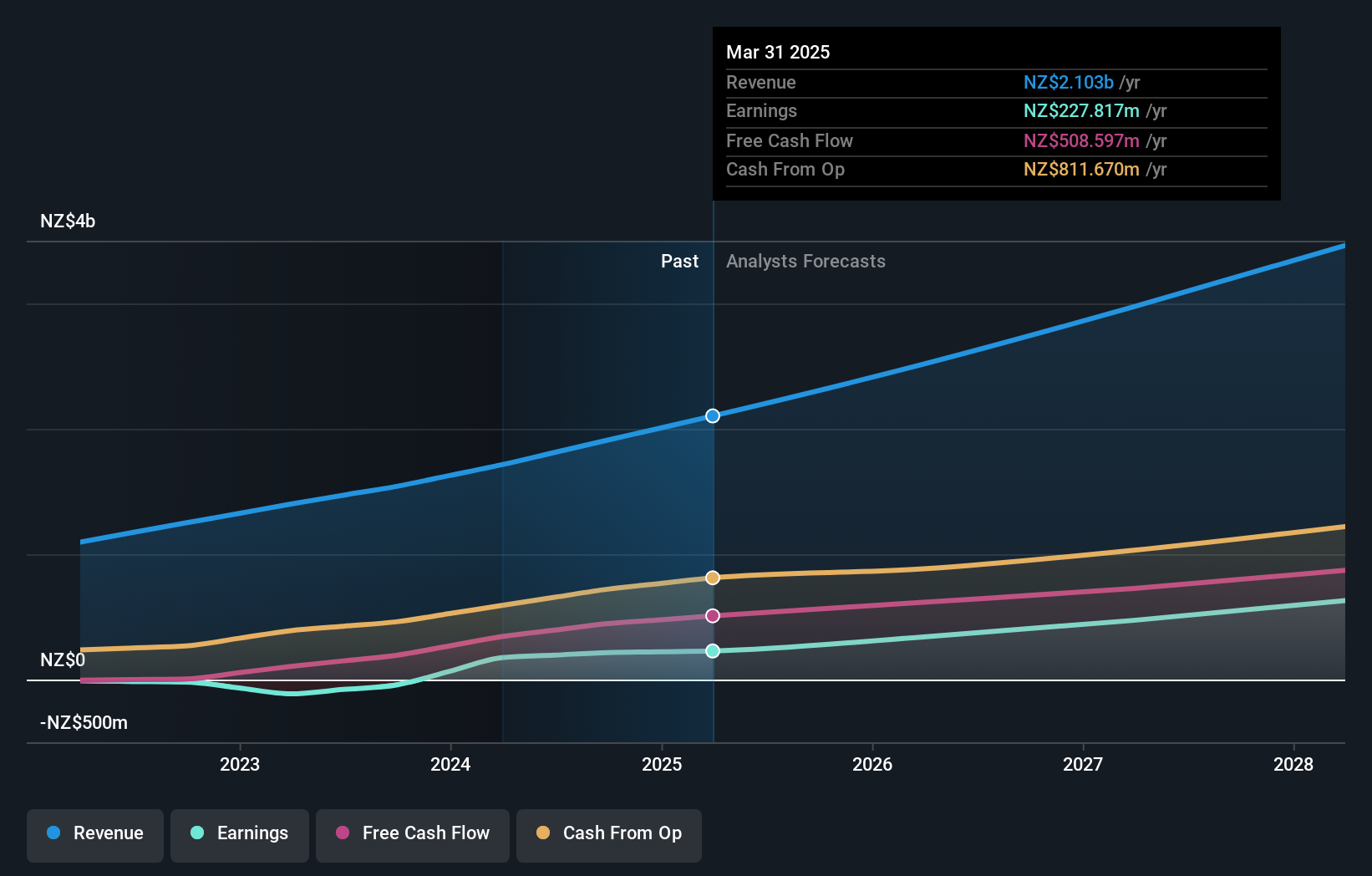

Overview: Xero Limited, along with its subsidiaries, is a software as a service company offering online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally, with a market cap of A$22.77 billion.

Operations: Xero Limited generates revenue primarily through providing online solutions for small businesses and their advisors, amounting to NZ$1.71 billion. The company operates on a software-as-a-service model across Australia, New Zealand, and internationally.

Xero, amidst a leadership transition with CFO Kirsty Godfrey-Billy’s upcoming departure, continues to innovate aggressively in the tech landscape. The launch of Xero Inventory Plus marks a significant stride in enhancing operational efficiencies for small businesses across the US, integrating seamlessly with platforms like Amazon’s FBA and Shopify. This product expansion aligns with Xero’s 13.5% revenue growth forecast, outpacing the broader Australian market’s 5.4%. Moreover, Xero’s commitment to R&D is evident as it fuels anticipated earnings growth of 24.2% annually, reflecting both innovation and market adaptation strengths despite recent executive changes.

Seize The Opportunity

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hansen Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024Here’s why Golf Twitter lost its damn mind over Team Langer’s PNC victory – Australian Golf Digest

-

December 23, 2024From smaller homes to screen time, backyard cricket is facing challenges in modern Australia

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World