High Growth Tech Stocks in Australia Featuring These 3 Promising Companies

- by Admin

- September 24, 2024

The Australian market has climbed 1.4% in the last 7 days, led by a gain of 2.3%, and over the past year, it has risen by 15%, with earnings expected to grow by 12% per annum over the next few years. In this favorable environment, identifying high-growth tech stocks that align with these robust market conditions can offer promising investment opportunities.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 103.59% | 120.00% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| DUG Technology | 10.79% | 31.83% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies healthcare imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe, with a market cap of A$18.30 billion.

Operations: Pro Medicus generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. The company serves hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe.

Pro Medicus, a standout in the Australian tech landscape, recently showcased robust financial growth with its yearly revenue jumping to AUD 166.33 million from AUD 127.33 million, an increase reflecting a strong 16.7% growth rate. This performance is complemented by an impressive net income rise to AUD 82.79 million, up from AUD 60.65 million last year, marking an earnings surge of approximately 36.5% over the past year—significantly outpacing the industry average of 13.9%. Notably, R&D investments remain pivotal for Pro Medicus as they continue to innovate within healthcare technology—a sector demanding constant advancement.

Looking ahead, Pro Medicus appears well-positioned for sustained growth with earnings expected to climb by another 18.7% annually, outstripping broader market projections of a 12.3% increase in Australia’s tech sector revenues and profits are forecasted at this higher trajectory due in part to their strategic focus on high-quality non-cash earnings and efficient capital management evidenced by their recent dividend hike of over one-third to a fully franked annual rate of $0.40 per share.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$604.51 million.

Operations: RPMGlobal Holdings Limited generates revenue primarily from its software segment (A$72.67 million) and advisory services (A$31.41 million). The company operates across multiple continents, including Australia, Asia, the Americas, Africa, and Europe.

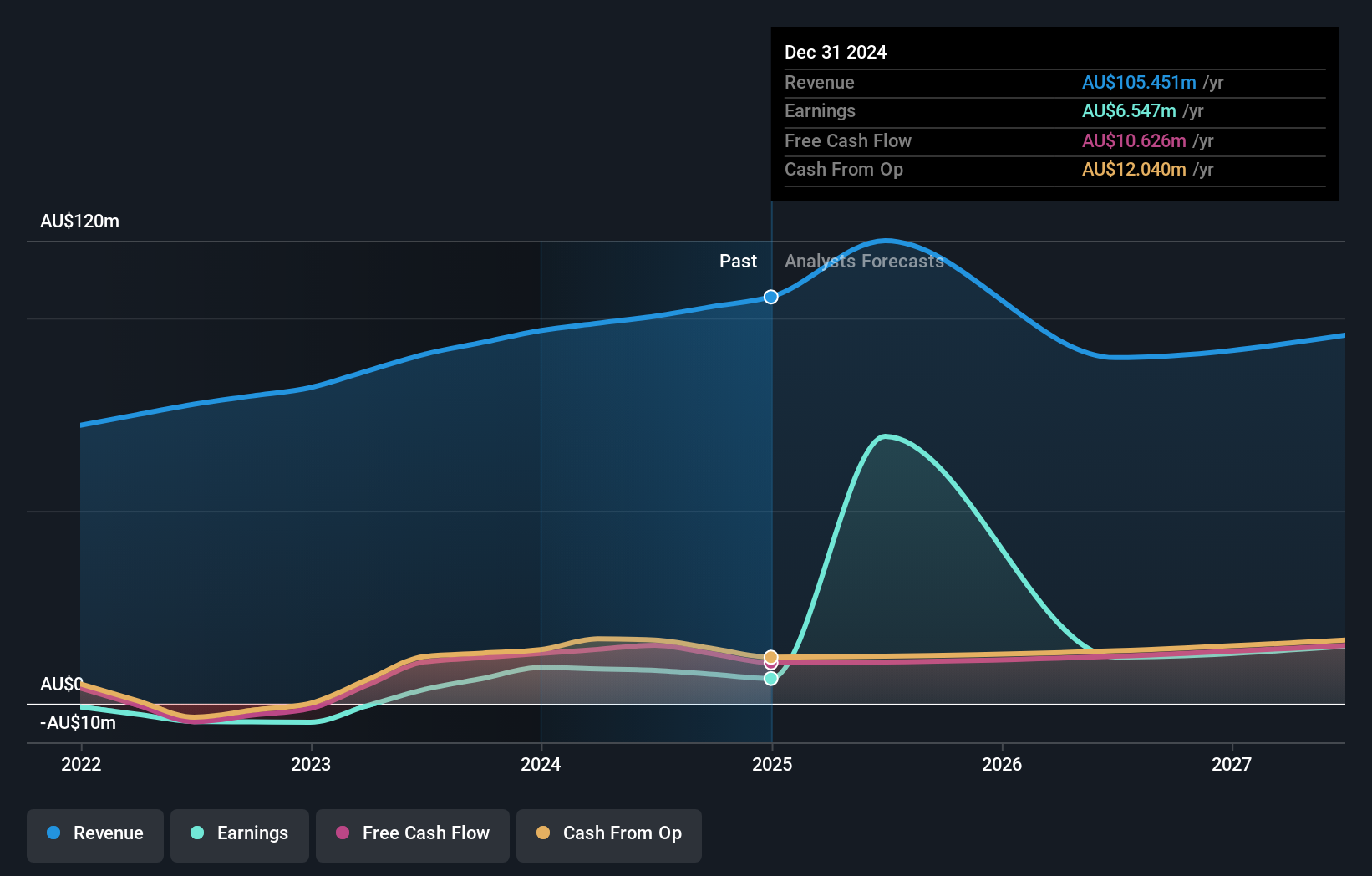

RPMGlobal Holdings has recently demonstrated a remarkable financial performance, with its revenue climbing to AUD 104.19 million, up from AUD 91.56 million the previous year—a solid growth of about 13.8%. This surge is mirrored in their net income which soared by over 134%, highlighting a robust profit acceleration that outpaces the broader software industry’s growth rate of just 6.8%. Notably, RPMGlobal’s commitment to innovation is evident in its R&D spending, crucial for maintaining competitive edge in the rapidly evolving tech landscape. The firm’s strategic inclusion in the S&P/ASX indices underscores its growing influence and potential within Australia’s tech sector. Looking forward, RPMGlobal is poised for continued expansion with earnings expected to grow at an impressive rate of 22.6% annually, significantly above the market forecast of 12.3%, signaling strong future prospects driven by sustained technological advancements and market penetration.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited, along with its subsidiaries, provides online employment marketplace services across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and internationally with a market cap of A$8.71 billion.

Operations: SEEK Limited generates revenue primarily through its Employment Marketplaces segments in Australia and New Zealand (A$840.10 million) and Asia (A$244 million). The company focuses on providing online employment services across various international regions.

Despite recent challenges, SEEK’s commitment to innovation remains evident with a strategic focus on R&D, crucial for its revival in the competitive tech landscape. Last year, the company allocated significant resources towards research and development, which is essential given its revenue growth forecast of 7.3% annually—outpacing the Australian market average of 5.4%. Moreover, earnings are expected to surge by 40.5% per year, showcasing potential for substantial improvement in profitability. This financial trajectory coupled with a recent dividend payout of AUD 0.16 per share underscores SEEK’s efforts to balance shareholder returns with necessary reinvestment into its core operations.

Make It Happen

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 23, 2024Here’s why Golf Twitter lost its damn mind over Team Langer’s PNC victory – Australian Golf Digest

-

December 23, 2024From smaller homes to screen time, backyard cricket is facing challenges in modern Australia

-

December 23, 2024This quiet Canadian will make you love YouTube golf again – Australian Golf Digest

-

December 23, 2024Guide Helps Australian Workers Expose Tech Wrongdoings

-

December 23, 2024PPHG achieves GSTC multi-site certification for all its Australian properties – Travel And Tour World