Market snapshot

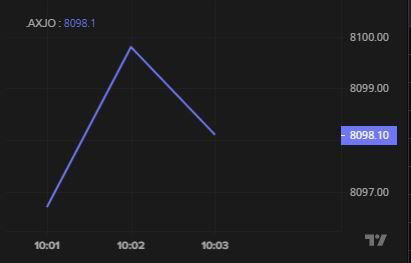

- ASX 200: +0.16% to 8,097 points (live values below)

- Australian dollar: Flat at 67.71 US cents

- S&P 500: -0.3% to 5,616 points

- Nasdaq: -0.9% to 17,725 points

- FTSE 100: +0.5% to 8,327 points

- EuroStoxx 50: -0.3% to 4,396 points

- Spot gold: -0.04% to $US2,515/ounce

- Brent crude: -0.23% to $US81.24/barrel

- Iron ore: +3% to $US98.05/tonne

- Bitcoin: -0.8% to $US62,916

Prices current around 10:30am AEST.

Live updates on the major ASX indices: