Melbourne company collapses owing $900k

- by Admin

- April 18, 2024

An Australian company has collapsed leaving a trail of creditors owed more than $900,000, including up to 20 customers who had paid deposits but never had the work done.

Melbourne (Wholesale) Roller Shutters went into liquidation in March with 41 unsecured credits left out of pocket by $908,000, according to an initial report from liquidators seen by news.com.au.

Nicholas Giasoumi and Shane Deane from Dye & Co have been appointed to oversee the

liquidation of the failed firm.

Melbourne (Wholesale) Roller Shutters offered the installation of roller shutters, as well as selling to tradies and the option to purchase rollers for DIY fitting.

Mr Giasoumi told news.com.au that there were between 15 and 20 customers who would be left out of pocket by the company’s failure last month after paying for shutters that were never installed.

“It wasn’t massive but to them it was massive in that it was in the hundreds to low thousands of dollars. Obviously they had an expectation of work and there is difficulty to get tradespeople out to a property and now they face a delay to start again,” he said.

“Some paid deposits and got nothing for it, so there is not so much in terms of massive dollar value but there’s the inconvenience and every dollar is a dollar.”

Karina English was one customer who has been impacted by the collapse.

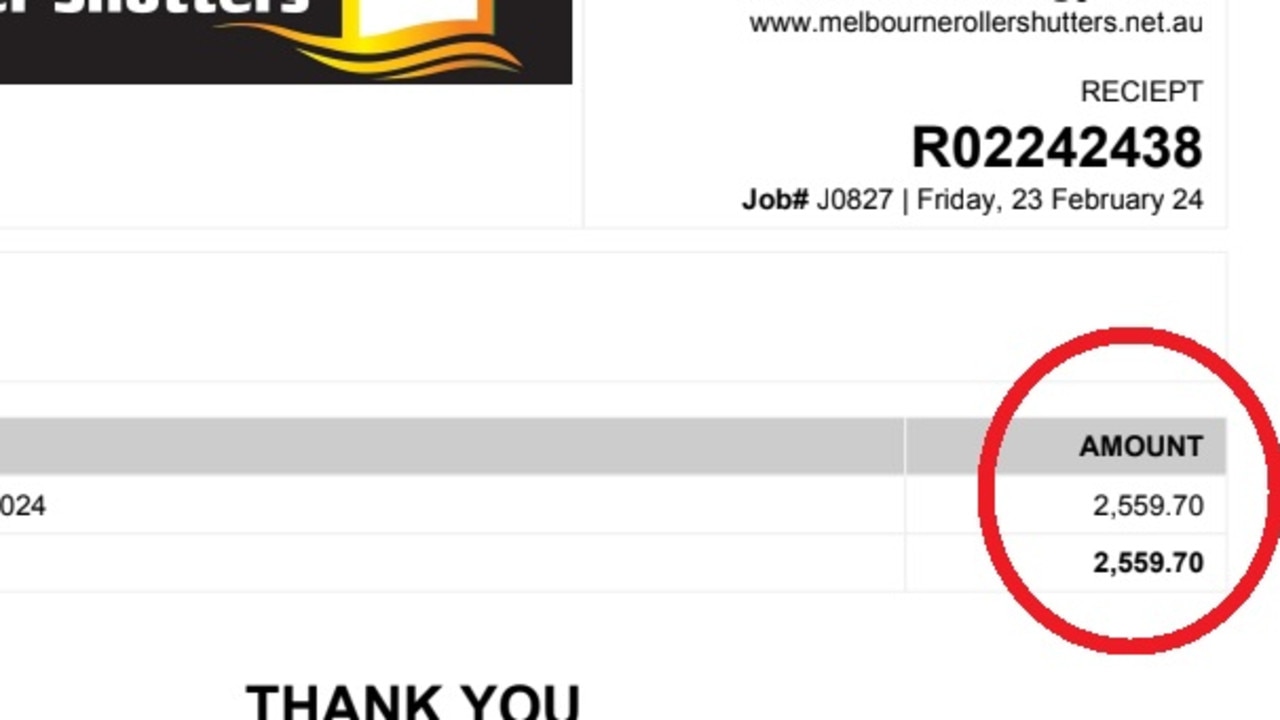

Along with her husband, the couple visited the company’s showroom and put down a deposit of $2559 for the installation of a roller shutter in their home.

But after paying the deposit on February 19 and waiting for installation to occur, the company went into liquidation just weeks later on March 8.

The 63-year-old said the situation has been an “added stress” as her husband has been in hospital and she only found out the company had failed by “fluke” when she called them to follow up on the job.

“I’m confused and a bit upset because when this was all happening it was only a matter of weeks before they went into receivership,” she said.

As retirees, Ms English said it was lot of money to lose for the couple.

“We will delay having to put it in because both of us are on a pension and in this day and age the pension doesn’t go that far, so you don’t really get a chance to save anything,” she said.

“We just wanted to put a blind in and unfortunately we picked the wrong company.”

The Melbourne woman said she had been told by the liquidators that it was unlikely they would get their money back too.

“Basically they have got to pay all their creditors first and if there is anything left we might get something but basically I was told don’t hold your breath and chances are you aren’t going to get anything back so it wasn’t too positive,” she added.

Melbourne (Wholesale) Roller Shutters went bust due to a few debtors that “went broke” and never paid the firm, as well as the accumulation of coming out of Covid and a lack of working capital, Mr Giasoumi said.

While the company went under with assets worth $58,000, it left a pile of creditors owed $908,000 including other shutter suppliers, trades, ANZ and customers.

The Australian Taxation Office was also owed more than $400,000.

Four employees were also impacted and will miss out on superannuation payments, Mr Giasoumi said.

Unsecured creditors listed in the liquidator’s report were owed amounts between $234 and $120,000, the liquidator’s initial report revealed. Mr Giasoumi said the chances of creditors getting their money back was “not great”.

It comes as a record number of businesses across Australia are collapsing.

Credit reporting agency CreditorWatch revealed that the number of external administrators appointed to Australian businesses had hit a record high and was now 22.1 per cent higher than a year ago with the construction sector most prominently impacted.

News.com.au has reported on dozens of builders going into administration and liquidation over the past two years as well as associated trades.

NSW construction company Viridi Group has been forced into administration as a result of the temporary suspension of a government contact worth millions, putting 115 jobs at risk.

Melbourne-based company MadeCo, which was responsible for kitchen manufacturing, went bust leaving it $2.5 million in debt last month.

Other recent collapses include workers at two NSW factories who slammed their former employer after the company went bust, leaving them and other creditors multiple millions out of pocket.

In February, Cubitt’s Granny Flats and Home Extensions announced that it had made the “devastating decision” to put itself into voluntary administration with $5.6m in liabilities, while a company involved in the construction sector collapsed with just $6 left in its bank account and now owes creditors more than $2 million.

A global company LVX involved in the construction sector and headquartered in Australia also plunged into administration earlier this month.

sarah.sharples@news.com.au

The Latest News

-

December 22, 2024AFL legend Aaron Shattock placed in induced coma following freak accident while operating an excavator

-

December 22, 2024Test discard brings the heat after Boxing Day axing

-

December 22, 2024Australian cricket team at MCG: Near 60% win record, unbeaten for three years | Cricket News – Times of India

-

December 22, 2024Zheng to skip United Cup, focus on Aussie Open

-

December 22, 20242024 runner-up Qinwen Zheng pulls out of Australian Open lead-in event