Retirement Special: Planning For Your Golden Years – Australian Golf Digest

- by Admin

- July 23, 2024

New research is shedding light on what makes retirement rewarding. And guess what? Golf has an important role to play

You’ll always find Pete, Roger and Liz* in the same spot on a Thursday morning – every Thursday morning. And that’s at their local golf club, where for the past six years, these retirees have gathered each week rain, hail or shine to play a round, have a stroll in the fresh air, hopefully hit the ball straight and enjoy a coffee afterwards. It’s a highlight of their week, and a fixture in their diaries. And without even knowing it, their Thursday morning round is scoring a hole-in-one when it comes to what will make their retirement a happy one.

According to new research, there are five main drivers of happiness in retirement. In collaboration with the research house YouGov, Australia’s leading retirement income provider, Challenger, surveyed more than 1,000 Australians older than 60 to explore the dimensions of retiree satisfaction. It revealed that health, activities, people, purpose and money topped the list. And the good news for anyone who enjoys a regular round – and perhaps would like an excuse to spend more time on the green – is that golf can help with four of these aspects. And for the fifth driver? It’s time to get some tips from the retirement income experts.

Money matters

For Australians older than 60, having enough money to enjoy life after leaving the workforce join physical and mental health as the top three most important elements needed for a happy retirement. The Challenger Happiness Index showed that more than seven in 10 agree that a guaranteed income in retirement would significantly boost happiness, with more than 40 per cent strongly agreeing. But when it comes to how the respondents currently feel, financial stability was on par with physical health as the area with most potential for improvement in enhancing overall wellbeing.

If the current economic climate and rising costs of living have come up during conversations over post-golf coffee, it won’t be surprising to hear that many Australians older than 60 are seeking financial stability – and that there is a gap between where their sense of security currently stands and where they’d like it to be. Two in three expressed the pressure of rising costs of living is impacting their confidence in having sufficient retirement funds. “A better retirement is about so much more than finances, but having a degree of confidence that your savings will last plays an important role,” says Challenger’s chief executive, customer, Mandy Mannix.

That’s why having a retirement plan – and understanding your income options – are so important.

The first step is to think about what you want from your retirement. Every retirement is different, so the income you receive should be tailored to your individual wants and needs, whether that be travelling to the world’s best golf courses or spending more time with your family. The next step is to think about what level of risk you’re comfortable taking with your investments. Generally, the higher the expected return, the higher the risk involved. Taking on too much risk could lead to steep falls in the value of your investments, while taking on investments with the least possible risk can make it difficult to earn investment returns that keep up with inflation and any rises in living costs.

It’s why diversification is a golden rule in investing. Spreading investments across different asset classes can strike a balance between security and potentially higher investment returns. This can reduce your overall investment risk. Because we’re all living longer these days, there may be up to three decades to plan for, so it’s important to know you’ll have income, regardless of how long you live (and here’s to your good health!). Superannuation is far from your only option: most people will rely on other sources such as income from other investments like shares or property or the Age Pension.

Experiencing the stability of income for life when you’re no longer receiving a regular pay cheque could make all the difference between stressing about money and reveling in your retirement. A guaranteed lifetime income stream, such as a lifetime annuity, delivers guaranteed regular income payable for life, in return for a lump sum from your super or savings.

Let’s check-in with Roger and Liz on how they are achieving their retirement goals as they step onto the green. Roger and Liz, both aged 67, are avid golf enthusiasts. They are navigating their retirement plan that supports their lifestyle and future aspirations. They have $900,000 in superannuation (combined), $50,000 in cash/term deposits, $20,000 in non-financial assets and own their own home. They want to be able to spend comfortably but confidently through retirement. They are happy that their current home is where they would like to live for most, or all, of their retirement. They are keen to help their kids and grandkids from time to time and will do this from their retirement income rather than their retirement savings. They are keen to leave their kids a benefit after their eventual deaths (hopefully many decades into the future) but, in terms of prioritisation, they are broadly comfortable preferencing their retirement spending over their estate value.

Roger and Liz’s challenge to their financial planner, Meika*, was to develop a retirement drawdown strategy that lets them draw sufficient retirement income each year to meet their lifestyle goals and with a suitably high level of confidence that their goals could continue to be met through a long retirement.

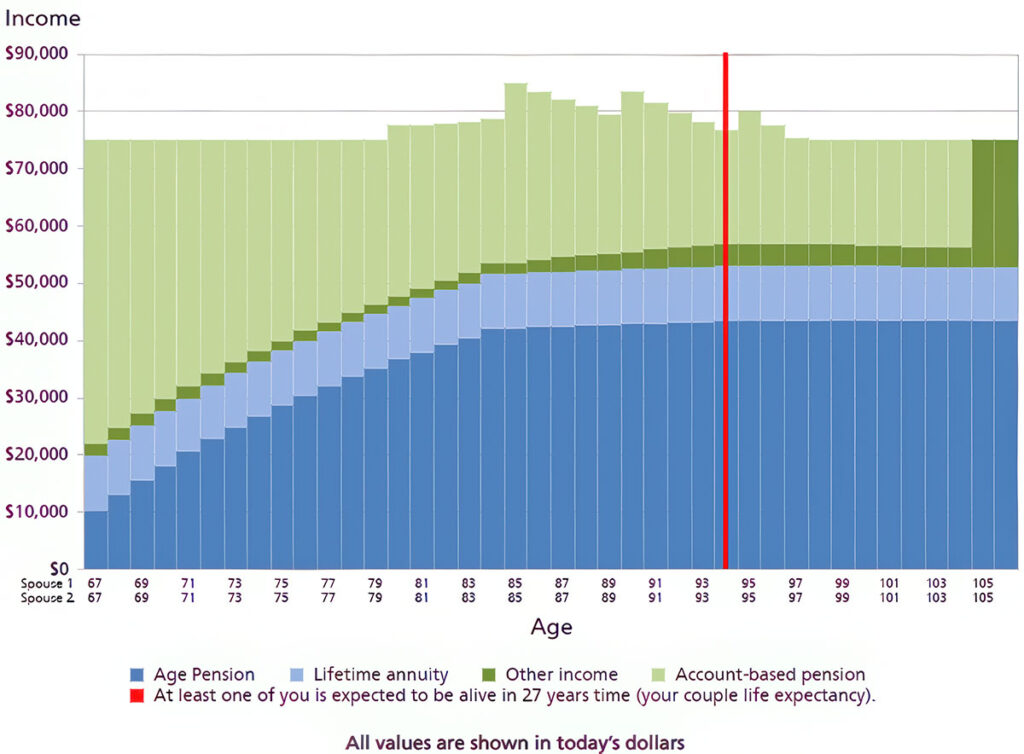

Meika has come back to Roger and Liz with a drawdown strategy she believes will meet their requirements. A total retirement income drawdown starting at $75,000p.a. and increasing with inflation is shown in Meika’s modelling to have a high chance of being sustained to Roger and Liz’s couple life expectancy. This drawdown retirement income strategy is shown in the first graph [above].

This initial analysis shows income projected to last past age 98 (beyond their couple life expectancy) and will meet Roger and Liz’s “comfortable” income requirements.

Guaranteed lifetime income can also be useful for clients in improving the likelihood of achieving their retirement income goals. A partial allocation to guaranteed lifetime income can also improve total portfolio and estate outcomes.

With this in mind, Meika has modelled the outcomes a 20 percent allocation to guaranteed lifetime income (in the form of a guaranteed, CPI-linked lifetime annuity) would deliver for Roger and Liz. The income from this combination of income streams is shown in the next graph [below].

In this further analysis, a 20 percent allocation to a CPI-linked lifetime annuity can help Roger and Liz meet their desired level of spending for longer (with their income target of $75,000p.a. projected to be met for an additional five years). This 20 percent allocation to a CPI-linked lifetime annuity could also improve the chance of meeting their desired level of income to couple life expectancy.

Importantly for Roger and Liz, this 20 percent allocation to guaranteed lifetime income also ensures that even where their total retirement income objective of $75,000p.a. is not met (because their retirement savings have been depleted), their guaranteed lifetime income (in addition to any Age Pension they may be eligible) will be sufficient in 100 percent of modelled scenarios to meet a minimum level of income of $52,000p.a. in today’s dollars (sufficient to meet their essential spending requirements and comfortably greater than income from just the Age Pension alone).

Finally, this 20 percent allocation to guaranteed lifetime income is projected to increase Roger and Liz’s estate value (at couple life expectancy) by more than $80,000 in today’s dollars.

Roger and Liz’s retirement strategy demonstrates how combining traditional drawdowns with lifetime annuities can support both their immediate lifestyle and their legacy – helping their financial and golf game stay strong.

Benefits of lifetime annuities

There are a number of potential benefits that a partial allocation to a guaranteed lifetime income stream can bring such as:

- Increase your retirement income over your lifetime;

- Increase the likelihood of you meeting your retirement spending objectives (giving you more confidence with your spending);

- Improve your Age Pension outcomes;

- Help protect you against financial risks in retirement (such as longevity risk – the risk of outliving your retirement savings); and

- Improve portfolio and estate outcomes.

Challenger offers lifetime annuities that can be linked to yearly CPI inflation changes, which can help give peace of mind now as well as helping maintain living standards over the years. By providing a guaranteed regular income that adjusts with inflation, a lifetime annuity can help retirees plan for long-term expenses and enjoy their activities without worry, knowing that their needs are covered regardless of economic shifts. Challenger lifetime annuities are intended to be held for life. As part of a diversified retirement plan, CPI-linked annuities could reduce anxiety about the financial future, allowing retirees to focus on enjoying life.

As with all investments, lifetime annuities carry some risks. You should consider your financial circumstances and goals before investing in any products and read the Product Disclosure Statement or talk to a financial adviser.

A body boost

Now your finances can be on their way to being future-proofed, let’s look at another aspect of retirement happiness: physical health, which topped the list of priorities respondents gave for a happy retirement. Losing physical health was the No.1 concern for them around getting older, and 70 per cent said it was the most important element of a happy retirement. It’s also the area that was flagged for the most potential for improvement in enhancing overall wellbeing.

The health benefits of golf are well researched and established; the distance walked during a round of golf and the swinging, twisting and bending motions that maintain or improve joint mobility can be key to keeping players healthier, longer. You can walk 13,000 steps during an 18-hole round (depending on where your ball goes!), well above the recommended 10,000 daily steps.

Swing for stress relief

If that doesn’t have you itching to pick up a 9-iron, consider this: golf turns the dial on your mental health, too. Challenger’s Happiness Index revealed that good mental health was the next most important aspect of a healthy retirement, and golf can help boost psychological wellbeing in three key ways: it facilitates social interaction, while offering the type of regular, moderate intensity exercise that releases endorphins and serotonin, improves mood and reduces stress, depression and anxiety.

The golf trifecta

We know that group activities facilitate social interaction and counteract loneliness and isolation – it’s simply common sense. And hobbies and interests are very important to the Australians aged older than 60 who were surveyed in Challenger’s Happiness Index: they nominated them as contributing the most to their current happiness levels. After his wife passed away, Pete – one of the Thursday morning golfers for whom a quick round means more than just fresh air and some practice – felt adrift. Then, he was invited to join a weekly golf group. Having somewhere to be each week, and people relying on him, gave him a sense of purpose as well as community. The time on the golf course as well as the chats over coffee can really help.

His story speaks to three key drivers of happiness in retirement the Challenger Happiness Index identified: activities, purpose and people. When you can enjoy a hobby or interest, with a side of social connection, that helps give you purpose and meaning about your place in the world, so you’re winning at more than just a game of golf. After all, meaning isn’t necessarily about changing the world – it can be as simple and knowing that what you’re doing throughout your day is contributing to your community, while boosting your own wellbeing.

To see how Challenger can help you reach your financial goals for a happier retirement, speak to your financial adviser, call us on 13 3566 (from 8am to 6pm AEST, Monday to Friday) or e-mail us at info@challenger.com.au. Challenger provides market-leading retirement income products to tens of thousands of customers as Australia’s largest annuity provider.

*Pete, Roger, Liz and Meika are fictional characters created for the purpose of illustration. Any resemblance to actual persons, living or dead, or to actual events, is purely coincidental.

Assumptions:

To view all the assumptions used in the hypothetical case study, please refer to this link: https://www.challenger.com.au/-/media/shared/challenger/document/case-studies/ll-ga-hnw-casestudy-michael-and-michelle#page=9

Disclaimer:

This case study relates to a hypothetical couple, and is provided for illustrative purposes only. This case study is not intended to reflect any particular person’s circumstances. This case study includes statements of opinion, forward looking statements, forecasts or predictions based on current expectations about future events and results. Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown risks and uncertainties that are not able to be presently identified. Any reference to the aged pension is illustrative only. Any reference to Centrelink is for illustrative purposes only. It is based on information that is current as of July 1, 2024, unless otherwise specified and is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670, the issuer of the Challenger Guaranteed Annuity (Liquid Lifetime) (Annuity). It is intended to be general information only and has been prepared without taking into account any person’s objectives, financial situation or needs. Each person should, consider its appropriateness having regard to these matters and the information in the Target Market Determination (TMD) and Product Disclosure Statement (PDS) before deciding whether to acquire or continue to hold the Annuity. A copy of the applicable TMD and PDS is available at challenger.com.au or by contacting our Investor Services Team on 13 3566.

The Latest News

-

January 8, 20252025 Sony Open tee times, TV coverage, viewer’s guide – Australian Golf Digest

-

January 8, 2025Get set for the Australian Open 2025: key dates, draws and everything you need to know

-

January 8, 2025‘Feels like a bit of a novelty’: Australian all-rounder Ash Gardner endorses three-Test women’s Ashes series

-

January 8, 2025‘Biggest test’ facing Healy amid injury comeback

-

January 8, 2025Channel Nine turns two Aussie sport superstars into tennis commentators for the Australian Open in a VERY surprising decision