Top 3 High Growth Tech Stocks in Australia

- by Admin

- September 8, 2024

The Australian market has shown mixed performance recently, with the ASX200 closing up 0.39% at 8,013 points, driven by a rally in bank stocks while energy and mining sectors faced declines due to falling commodity prices. In this dynamic environment, identifying high-growth tech stocks becomes crucial as they can offer significant upside potential despite broader market volatility.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.63% | 22.01% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| DUG Technology | 10.90% | 32.21% | ★★★★★☆ |

| Careteq | 34.13% | 126.60% | ★★★★★☆ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Wrkr | 33.39% | 124.86% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$1.61 billion.

Operations: Nuix Limited generates its revenue primarily from software and programming, amounting to A$220.62 million. The company’s solutions cater to various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Nuix’s recent strategic alliance with Veritone aims to enhance their capabilities in handling complex data privacy, cyber-breach responses, and eDiscovery solutions. The company’s revenue grew by 20.91% to AUD 220.62 million for the year ending June 30, 2024, while net income turned positive at AUD 5.03 million from a previous net loss of AUD 5.59 million. With R&D expenses accounting for a significant portion of their budget, Nuix is poised to leverage its innovative Neo platform alongside Veritone’s AI models to meet increasing demands in data management and compliance sectors.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe, with a market cap of A$16.21 billion.

Operations: Pro Medicus generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. The company operates across Australia, North America, and Europe.

Pro Medicus’ revenue increased to AUD 166.33 million for the year ending June 30, 2024, marking a significant rise from AUD 127.33 million the previous year. With earnings growth of 36.5%, outpacing the Healthcare Services industry at 13.9%, and R&D expenses strategically allocated, this company is leveraging its advanced imaging software to meet rising healthcare demands globally. The forecasted annual profit growth of 18.7% underscores its robust market position and potential for sustained expansion in a competitive sector.

Simply Wall St Growth Rating: ★★★★★☆

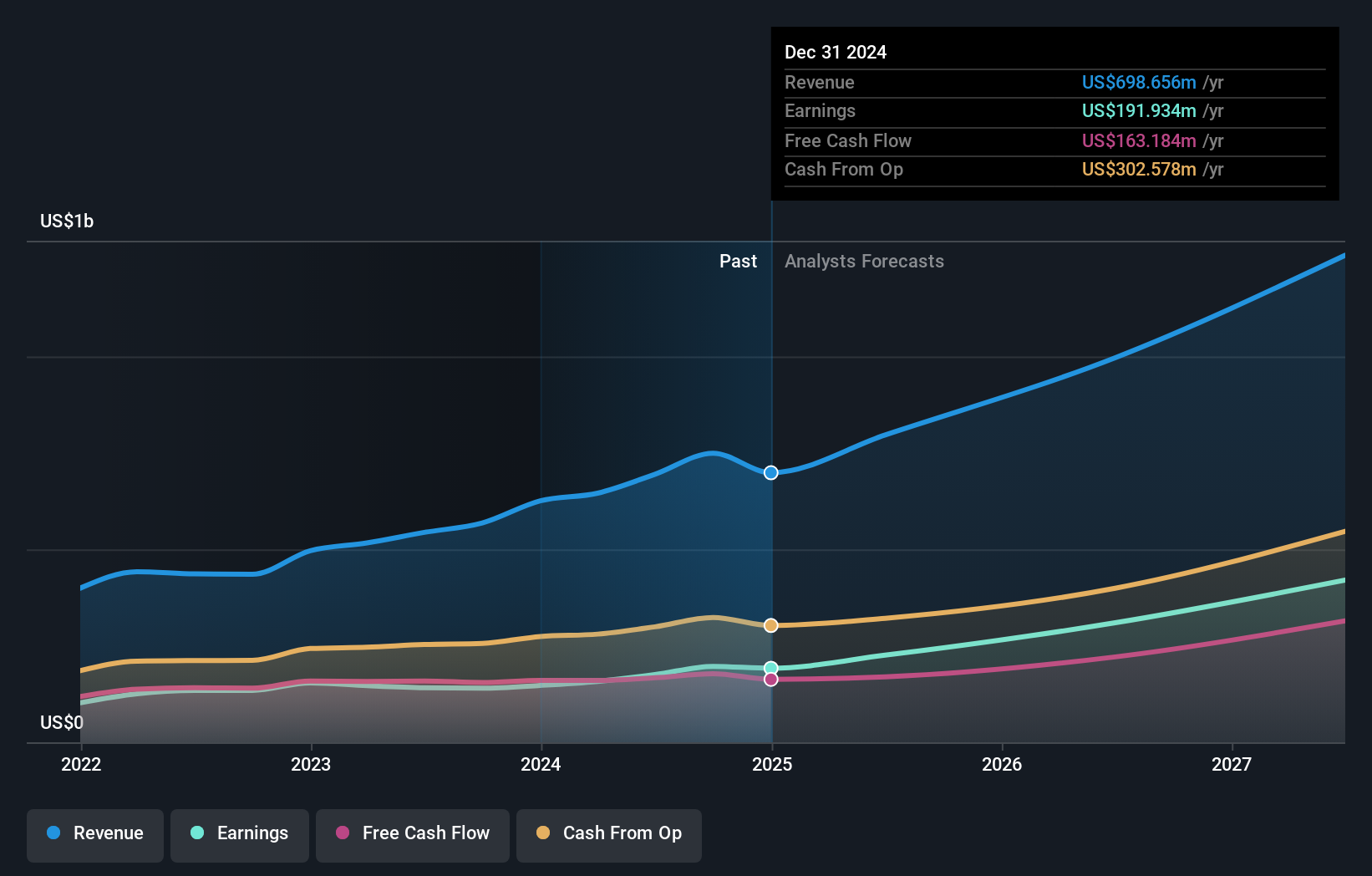

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$40.73 billion.

Operations: WiseTech Global generates revenue primarily from its Internet Software & Services segment, amounting to A$1.04 billion. The company’s software solutions cater to the logistics execution industry across multiple global regions.

WiseTech Global’s revenue grew to AUD 1.04 billion, a significant increase from AUD 816.8 million the previous year, with net income rising to AUD 262.8 million from AUD 212.2 million. The company forecasts earnings growth of 23.9% annually and revenue growth of 19.1%, surpassing the Australian market’s projected rates of 12.1% and 5.3%, respectively, thanks to its robust SaaS logistics platform that ensures recurring subscription revenue streams and high-quality earnings.

Investing heavily in R&D, WiseTech allocated over $100 million last year to innovate and enhance its software offerings, reflecting a commitment to maintaining its competitive edge in the tech industry through continuous improvement and technological advancements; this strategic focus on innovation is pivotal for sustaining long-term growth amidst evolving market demands.

Make It Happen

- Click here to access our complete index of 60 ASX High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 31, 2024‘Not a bad effort’: Cruz falls short to ex-world No.1’s son

-

December 31, 2024Opinion: 18 ways to fix men’s pro golf in 2025(or at least plan for it) – Australian Golf Digest

-

December 31, 2024Raducanu pulls out of Australian Open warmup with back injury

-

December 31, 2024We broke down the golf swings of 4 pro hockey players—what it revealed – Australian Golf Digest

-

December 31, 2024Jersey Jerry teases the return of his viral hole-in-one challenge at TGL’s SoFi Center – Australian Golf Digest