Top High Growth Tech Stocks To Watch In Australia October 2024

- by Admin

- October 1, 2024

Over the last 7 days, the Australian market has risen 1.7%, with notable movements in sectors such as Materials, which is up 12%, and Financials, which is down 3.2%. In this environment of overall growth and positive earnings forecasts, identifying high growth tech stocks can be crucial for investors looking to capitalize on robust market conditions.

Top 10 High Growth Tech Companies In Australia

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Clinuvel Pharmaceuticals |

22.32% |

27.42% |

★★★★★★ |

|

Adherium |

86.80% |

73.66% |

★★★★★★ |

|

ImExHS |

20.47% |

111.20% |

★★★★★★ |

|

Telix Pharmaceuticals |

20.10% |

38.31% |

★★★★★★ |

|

DUG Technology |

10.79% |

31.83% |

★★★★★☆ |

|

AVA Risk Group |

32.56% |

118.83% |

★★★★★★ |

|

Pointerra |

56.62% |

126.45% |

★★★★★★ |

|

Careteq |

37.17% |

126.21% |

★★★★★☆ |

|

Wrkr |

36.31% |

100.29% |

★★★★★★ |

|

Adveritas |

57.98% |

144.21% |

★★★★★★ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland with a market cap of A$1.38 billion.

Operations: The company generates revenue primarily through the development of its cell technology platform for commercialization, amounting to $5.90 million. With a market cap of A$1.38 billion, Mesoblast focuses on advancing regenerative medicine products across multiple international markets.

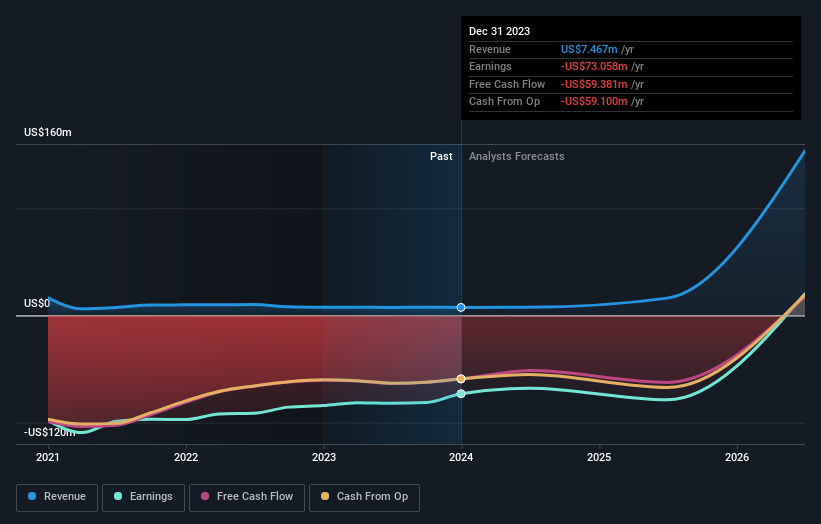

Mesoblast, navigating a challenging landscape in biotechnology, reported a revenue decline to $5.9 million from $7.5 million year-over-year and an increased net loss of $87.96 million, up from $81.89 million. Despite these financial setbacks, the company is poised for significant advancements with its lead product candidate Ryoncil (remestemcel-L), targeting pediatric steroid-refractory acute graft versus host disease (SR-aGVHD). The U.S. FDA’s acceptance of their Biologics License Application resubmission reflects potential market breakthroughs with projected revenue growth at 45.8% annually—outpacing the Australian market’s 5.5%. Moreover, Mesoblast’s strategic focus on high-stakes regulatory approvals could transform its financial trajectory as it anticipates profitability within three years amidst a forecasted earnings surge of 60.82% per year.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited, along with its subsidiaries, operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam and other international markets and has a market cap of A$27.83 billion.

Operations: REA Group generates revenue primarily through its online property advertising business, with significant contributions from Australia (A$1.25 billion) and financial services (A$320.60 million), as well as operations in India (A$103.10 million). The company operates across multiple international markets including the United States, Malaysia, Singapore, Thailand, and Vietnam.

REA Group, amidst a challenging fiscal landscape marked by a 15% earnings contraction, is setting sights on robust future growth with anticipated earnings expansion at 16.7% annually—outstripping the broader Australian market’s projection of 12.1%. This optimism is underpinned by strategic R&D investments aimed at enhancing its digital real estate services, which are crucial for sustaining innovation and competitive edge in the interactive media and services sector. Moreover, the recent decision to increase dividends by 23%, reflecting confidence in financial health and commitment to shareholder returns, aligns with their growth trajectory. Despite a downturn in net income from AUD 356.1 million to AUD 302.8 million this past fiscal year, REA’s forward-looking strategies and R&D focus position it well within Australia’s high-tech landscape as it navigates through transient challenges towards profitability.

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$45.59 billion.

Operations: WiseTech Global Limited focuses on creating software solutions specifically for the logistics execution sector, generating A$1.04 billion in revenue from its Internet Software & Services segment. The company operates across multiple regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

WiseTech Global, a standout in the tech sector, recently projected its revenue to surge by 25-30% next fiscal year, indicating robust growth potential. This forecast aligns with its past performance where earnings grew by 23.8% last year, outpacing the software industry’s average of 6.8%. The company has committed significantly to R&D with expenses rising to enhance technological capabilities and service offerings—an investment reflecting in their expected annual profit growth of 23.9%. Moreover, WiseTech’s strategic leadership changes and a recent dividend increase suggest confidence in sustaining this upward trajectory amidst dynamic market conditions.

Summing It All Up

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:MSB ASX:REA and ASX:WTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The Latest News

-

December 21, 2024‘Dream come true’: Emotional Test bolter on shock call-up and classy act from man he replaced

-

December 21, 2024‘Got this wrong’: Former skipper criticises selectors’ call

-

December 21, 2024The Kings horse Gilded Water wins at Randwick races

-

December 21, 2024Nick Kyrgios has chance to become first player ‘to do it all’, says tennis great in big statement about Aussie

-

December 21, 2024Australia retains Rose Bowl after rain-affected victory